Classifying the Digital Asset Treasury Landscape

A strategic lens to map digital asset balance sheet exposure and operational crypto integration across entities and assets

From Headlines to Structure

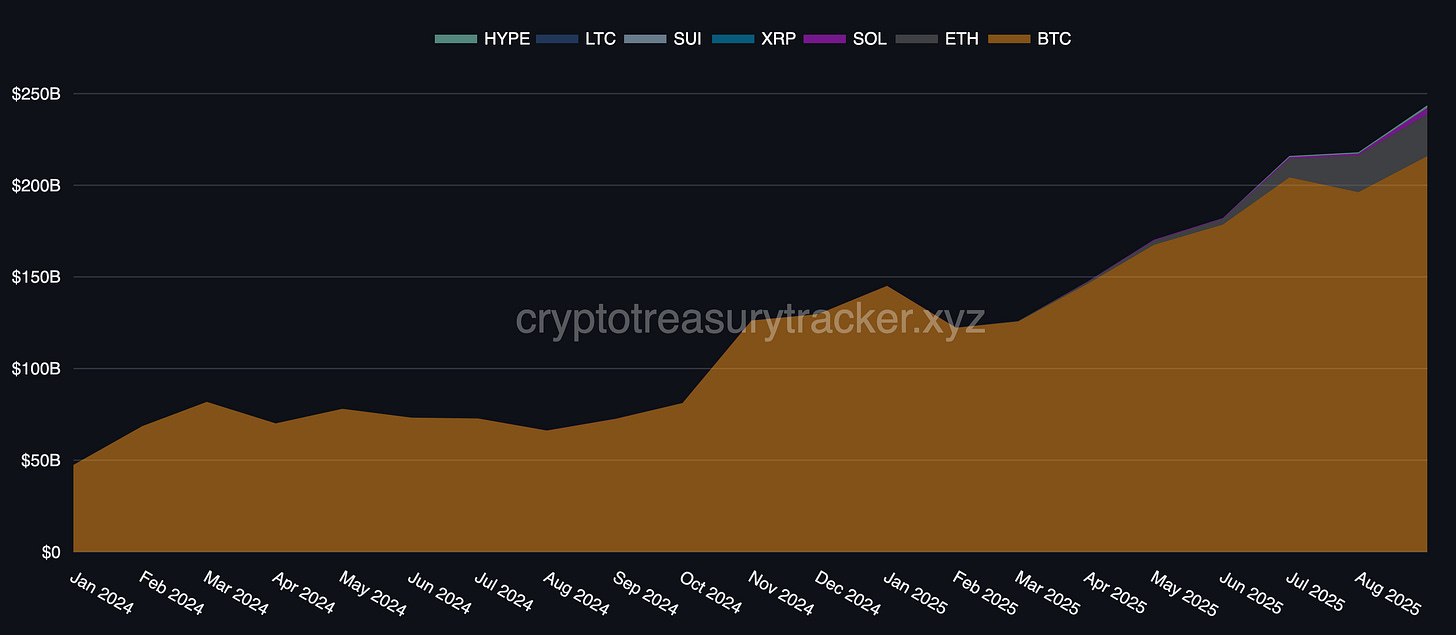

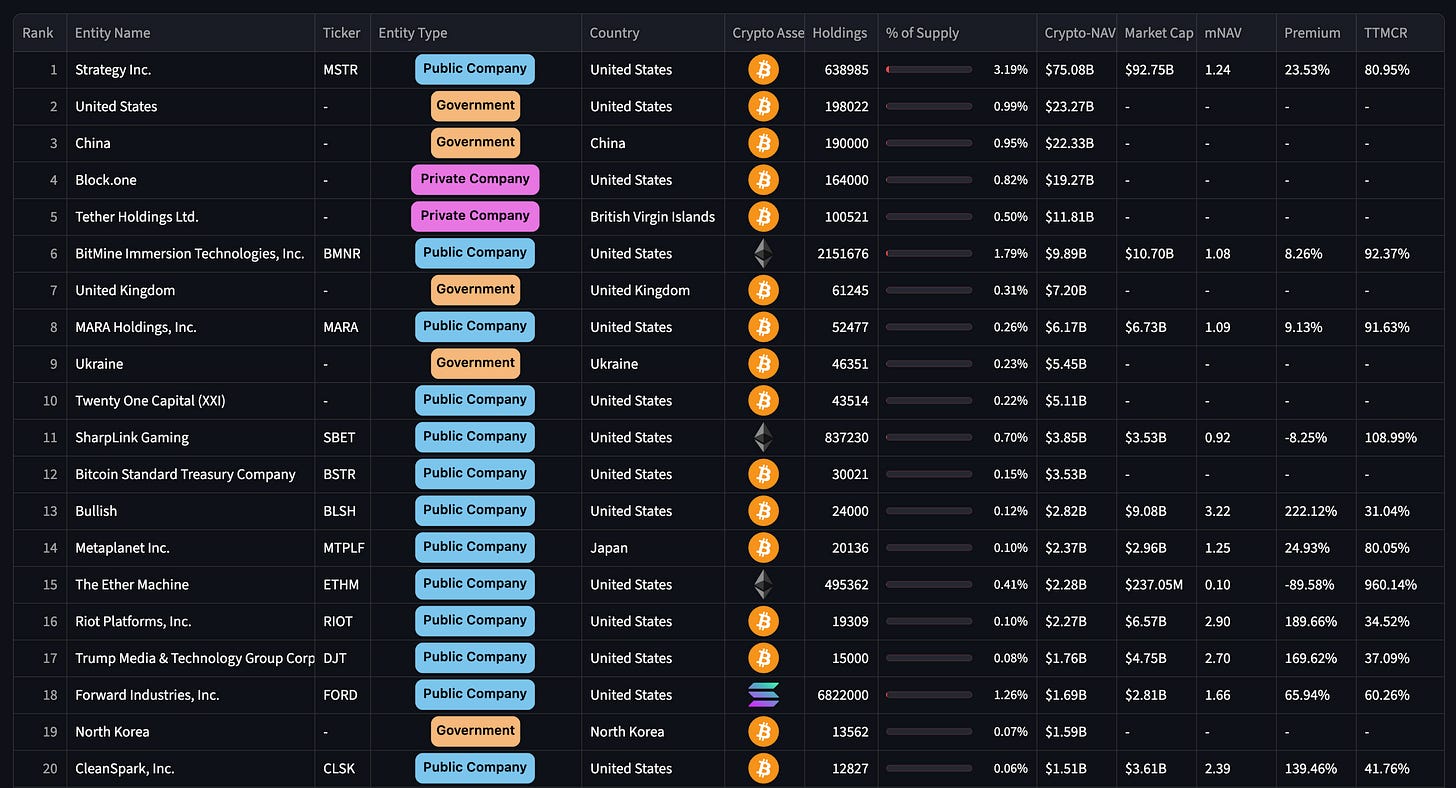

Over the past two years, digital asset treasuries (DATs) have shifted from isolated news events to a structural theme in global financial markets. By September 2025, entities hold over $240B in crypto on balance sheet, plus another $220B in spot ETFs and funds.

Bitcoin reserves still dominate wit a total value of $215B representing over 1.8M BTC held by corporates and sovereigns. But the picture is broadening. Ethereum treasuries have grown past $23B, and Solana reserves have climbed to about $3.4B, showing that treasury strategies are no longer Bitcoin-only.

Each of these assets comes with its own narrative and function. BTC is still viewed as a reserve asset and long-term store of value, often deployed as an inflation hedge. ETH and SOL play dual roles: they generate staking yield and form the infrastructure for tokenization, stablecoin settlement, and DeFi protocols. Meanwhile, other networks — from Hyperliquid to SUI — are carving out niches as settlement layers or ecosystem bets.

This diversity makes simple balance-sheet comparisons misleading. Strategy’s all-in Bitcoin play is not the same as Tesla’s modest hedge. Coinbase’s exchange business is fundamentally different from Forward Industries’ newly launched Solana treasury program. Without a structured approach, these motives and exposures get blurred together, leaving investors, policymakers, and market participants with an incomplete picture.

To separate these cases, we need a shared framework that compares not just how much crypto is held, but why it is held and how it connects to the underlying business model.

Mapping Treasury Holdings and Business Logic

Across corporates, sovereigns, foundations, and DAOs/protocols, we now observe distinct motives in how digital asset reserves are built and used. Some entities hold crypto as a portfolio hedge for inflation or currency risk protection, or to diversify away from traditional asset risk, sometimes also to send innovation signals to markets. Others build reserves because they believe in asset appreciation and want exposure, transforming their balance sheet strategy. In addition, there are crypto-native businesses, such as exchanges, miners, or custodians, whose revenues depend on staking, transaction fees or similar. For them, crypto is part of operations, not just held capital. Ultimately, some entities combine reserve accumulation and operational activities, treating crypto as a store of value and business engine.

These motivations align with two key strategic dimensions:

how much of an entity’s balance sheet is allocated to crypto reserves, and

how deeply crypto is integrated into its business operations.

Together these dimensions distinguish between passive exposure and active crypto business models, resulting into four clear classes:

Digital Asset Reserve Diversifiers

Entities in this class aim to diversify macro risk (e.g., inflation, FX, and liquidity) while maintaining operational simplicity and governance discipline. They typically hold modest crypto positions passively, avoid staking or mining, and emphasize transparency. For sovereigns, this path retains optionality under IMF or fiscal programs while signaling technological openness. For example, El Salvador, which secures its BTC reserves across multiple addresses and publishes holdings to demonstrate transparency.Digital Asset Treasury Wrappers

Digital asset treasury wrappers (DAT Wrappers) offer listed, regimented exposure where the balance sheet is the product. These corporates typically raise equity or debt specifically to accumulate crypto, using At-the-Market Equity (ATM) Offerings or raising capital by selling shares directly to large, accredited investors (PIPEs), and communicate that discretionary reserve policy is the core strategy. Investors gain regulated, liquid exposure with audited disclosure, while management optimizes issuance, cost of capital, and treasury allocation. For example, Strategy positioning as a “Bitcoin Treasury Company” and new SOL-focused DATs like Forward Industries, who aspire to become “the most natively onchain public company.” Notably, ETFs/funds fall also under DAT wrappers but they offer passive exposure by design (not as a strategic “business decision”).Crypto Operators

These organizations monetize crypto infrastructure by trading, custody, staking rewards, mining, payments, while avoiding large balance-sheet exposure. Risk is tied to volumes, fees, protocol rewards, and competitive dynamics, not Net Asset Value (NAV) volatility. For regulators, this group represents market plumbing and systemic touchpoints, distinct from balance-sheet vehicles like Strategy or BitMine Immersion Technologies. For instance, crypto exchanges like Coinbase, which derives most revenue from trading, custody, and staking fees, and blockchain validators like Riot Platforms that convert block rewards to fiat to fund operations rather than accumulate reserves.Crypto Conglomerates

Conglomerates combine reserve leverage with operating leverage, amplifying equity beta while operating crypto-based businesses generate cash flow and market share. This profile requires advanced treasury and liquidity management and gives investors the highest combined exposure to crypto price and ecosystem growth. For instance, Marathon Holdings, which holds large BTC reserves while operating one of the largest mining fleets in the industry. Additionally, DAOs like Mantle and Arbitrum technically fit by combining large native token treasuries with active funding of ecosystem development, though their reserves are endogenous, i.e., their value is reflexive and governance-driven.

If you want to dig deeper into the rationales behind digital asset treasury strategies, read the article below.

The Crypto Treasury Classification Matrix (CTCM)

The observation that treasuries differ not only by size but by their role in the business model led to the Crypto Treasury Classification Matrix (CTCM). The CTCM is an actionable model that formalizes these behaviors on two measurable dimensions (Digital Asset Reserve Intensity and Operational Crypto Integration).

Digital Asset Reserve Intensity (Y-axis)

Share of balance sheet allocated to crypto reserves (Treasury-to-Market-Cap-Ratio (TTMCR) for corporates, NAV share for funds, treasury/Full Diluted Value (FDV) for DAOs, reserves/budget share for sovereigns).

Operational Crypto Integration (X-axis)

Degree to which crypto is essential to revenues or activities (ideally revenue share; practical proxies include exchange operation, mining/staking, payments and settlements, yield farming, lending/borrowing spread, issuance of crypto products).

These dimensions create four distinct quadrants:

Digital Asset Reserve Diversifiers are diversified entities with small, non-core allocations where crypto is a hedge or optional reserve.

Digital Asset Treasury Wrappers (or DAT Wrappers) showing entities whose balance sheet is the product, including corporate DATs and passive ETFs/funds.

Crypto Operators run businesses with crypto-native revenues but modest reserves. The valuation is driven by operating metrics.

Crypto Conglomerates present hybrids with high crypto exposure and high operational integration. Reserves and operations jointly drive equity risk/return.

Case Study: Applying the CTCM

Tesla

Holdings: 11,509 BTC; TTMCR: ~0.1%; Ops Integration: —

Analysis: a small balance-sheet hedge, not a strategic driver.

Classification: —> Digital Asset Reserve Diversifier

Strategy

Holdings: 638,985 BTC; TTMCR: ~80%; Ops Integration: —

Analysis: textbook listed treasury company; balance sheet is the product.

Classification: —> DAT Wrapper (Corporate DAT)

Coinbase

Holdings: 11,776 BTC + 136,780 ETH; TTMCR: <3% combined; Ops Integration: very high (>60% revenue from trading, custody, staking, subscriptions)

Analysis: operating exposure dominates; treasury is secondary.

Classification: —> Crypto Operator

MARA Holdings

Holdings: 52,477 BTC; TTMCR: >90%; Ops Integration: fully crypto-native mining

Analysis: reserve-heavy operator; clear high-high quadrant case.

Classification: —> Crypto Conglomerate

El Salvador

Holdings: 6,318 BTC; Sovereign BTC reserve holder; Ops Integration: distributing Bitcoin across multiple addresses and dashboard transparency

Analysis: macro-reserve stance and geopolitical hedge with low operational integration.

Classification: —> Digital Asset Reserve Diversifier

Forward Industries

Holdings: 6,822,000 SOL; TTMCR: ~65%; Ops Integration: staking, DeFi spread strategy and on-chain company development plans

Analysis: SOL proxy vehicle for investors, but active staking plan and crypto ops target

Classification: —> DAT Wrapper (Corporate DAT) -> potential transition to Crypto Conglomerate

Mantle Network

Holdings: 95% MNT, <100% treasury-to-FDV; Ops Integration: funding grants, liquidity programs, and ecosystem infrastructure.

Analysis: high crypto exposure and crypto-native business

Classification: —> Crypto Conglomerate but we flag Mantle as endogenous token treasuries

Conclusion & Invitation

Crypto reserves are no longer a niche headline — they are shaping balance sheets, policy signaling, and investor exposures. The CTCM offers a consistent way to separate Digital Asset Reserve Diversifiers, DAT Wrappers, Crypto Operators, and Crypto Conglomerates and to benchmark them on like-for-like terms.

As treasuries, funding structures, and operations change over time, the model will evolve as new data improves transparency and revenue attribution, keeping the classification relevant as the market matures.

Explore live data and entity-level metrics in the Crypto Treasury Tracker and see where your organization fits.

If you find the CTCM valuable, please share it with your network.