Digital Asset Weekly #18: June 2, 2025

PSG Adds Bitcoin to Treasury, GameStop Wobbles on $512M BTC Buy, Stablecoin Impact on Treasury Rates Grows, and More!

Bitcoin cooled after a sharp pullback to $105K this week, with liquidations topping $680M across crypto markets. But a different kind of adoption is making headlines.

What else moved the market?

PSG Football Club adds Bitcoin to its treasury

GameStop tanks after $512M BTC buy

Stablecoin influence on Treasuries draws BIS attention

Enjoy reading!

Digital Asset Market Brief

Weekly updates on crypto markets, tokenized assets, stablecoins & macro signals.

1. Crypto Assets

Despite headlines around GameStop’s unexpected $512 million Bitcoin allocation, the move failed to stabilize either its own share price nor the broader crypto sentiment. The announcement landed in a jittery macro environment, where renewed trade tensions weighed on risk assets.

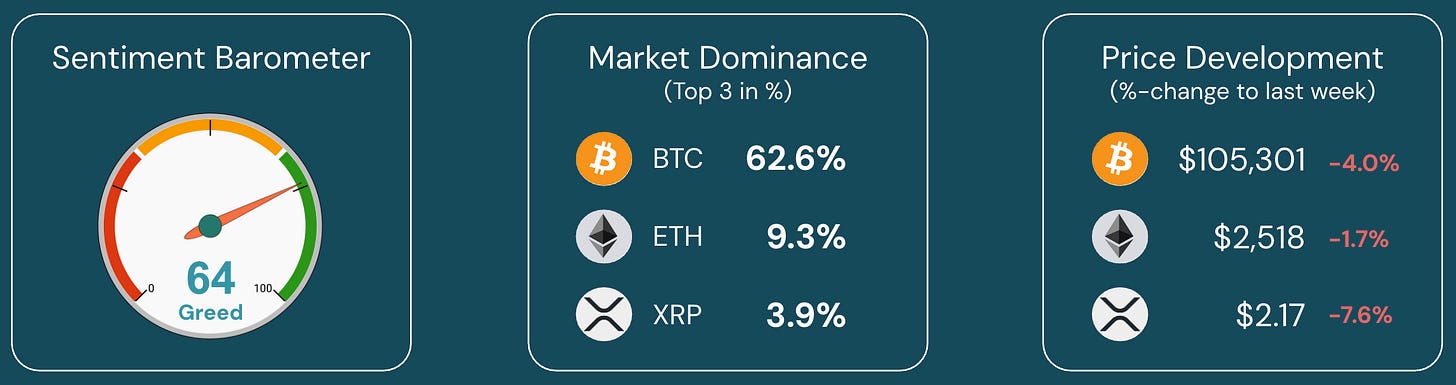

At the same time, BTC dropped to $105,301 (-4.0% w) amid broader risk-off sentiment driven by renewed global trade tensions, triggering over $683 million in liquidations. ETH and XRP saw smaller drawdowns.

Total market cap edged down to $3.41 trillion (-0.5%), while sentiment held steady at 64, suggesting resilient investor positioning despite volatility.

2. Digital Asset ETFs

Spot Bitcoin ETFs saw approximately $150 million in net outflows during the week, reversing the previous streak of steady inflows. Total ETF AUM declined marginally to $131.3 billion, tracking broader market softness.

3. RWA Tokenization

The tokenized RWA market grew to $23.1 billion, up 5% month-over-month. Institutional interest continues to deepen, with tokenized Treasuries and private credit driving adoption. Emerging pilots suggest increased comfort with on-chain debt infrastructure.

4. Stablecoins

New BIS data shows stablecoin issuers can exert measurable influence on short-term interest rates: For example, a $3.5 billion sale of Treasury bills could increase short-term yields by 6–8 bps, while equivalent purchases only reduce rates by ~3 bps. This asymmetry underscores growing financial stability concerns as stablecoin scale expands.

As volumes grow, stablecoins may weaken central banks’ monetary control, adding systemic risk alongside market utility.

Meanwhile, Circle, the issuer of USDC, announced a price range of $24–26 for its IPO, valuing the firm at $5.4 billion. Its upcoming listing on the NYSE (ticker: CRCL) adds further institutional momentum to the stablecoin sector.

5. Macro

Markets ended the week in the green despite Fed caution and renewed trade tensions. The S&P 500 rose 1.8%, capping a strong May.

As crypto markets fell triggered by stalled U.S.-China trade talks, gold and oil consolidated. Yet, falling Treasury yields reflect rising uncertainty over future rate decisions.

Top Story

This week’s most impactful digital asset headline.

PSG Football Club Adds Bitcoin to Treasury in Strategic First for Global Sports

Paris Saint-Germain Football Club (PSG), fresh off winning the UEFA Champions League final last Saturday, has become the first major global sports institution to publicly adopt a Bitcoin treasury strategy. At the Bitcoin 2025 conference in Las Vegas, Pär Helgosson, head of PSG Labs, confirmed that the club began allocating BTC from fiat reserves in 2024 and continues to hold the asset on its balance sheet.

From Experiments to Strategy

Crypto is not new to the world of football. Over the past few years, domestic clubs and supra-national federations have launched fan tokens and non-fungible tokens (NFTs), often riding speculative waves during major events like the FIFA World Cup.

Fan tokens (e.g. accessible via Socios) serve engagement and gamification goals, allowing fans to feel closer to their teams. While their collective market cap sits around $245 million, many underestimate the investment risks embedded in these instruments, which often fluctuate with team performance, news cycles, and speculative demand.

Top 5 fan tokens by market capitalization (Data: FanTokens.com) NFTs, on the other hand, function as digital merchandise, access passes, or licensed collectibles. They often offer fans exclusive content, experiences, or ownership of unique digital assets tied to their favorite teams or events. For instance, FIFA, recently migrated its NFT platform from Algorand to an Ethereum-compatible blockchain.

Digital fan pass issued by PSF as an NFT (Source: Concorde)

PSG was an early mover in this space, launching both a fan token and an NFT collection as part of its broader digital engagement strategy. But its Bitcoin move is categorically different. Such a treasury allocation reflects a monetary thesis, more akin to institutional asset management than community engagement.

Bitcoin as Long-Term Capital

The timing aligns with a broader resurgence of Bitcoin as strategic reserve capital as a long-term hedge. With over 80% of its 550 million fans under age 34, PSG is betting that digital-native finance will define the next generation of club-fan relationships.

Noteworthy, PSG Labs is also actively scouting and backing Bitcoin-native ventures, offering reach, capital, and infrastructure support.

The club is positioning itself not just as an early adopter, but as a bridge between global brand equity and decentralized innovation.

Outlook

The signal here is not retail speculation or PR. It’s that Bitcoin is increasingly treated as long-duration strategic capital. And now also from players outside the financial sector. This shift is significant, especially when it comes from brands with global influence and demographic scale.

Sources: CoinGecko, Decrypt, FanTokens.com, PSG (1, 2), RocketFan, TradingView, X

Regulatory & Policy Radar

Key developments in digital asset regulation and policy across major jurisdictions.

🇺🇸 SEC files to dismiss long-running lawsuit against Binance. 🔗 Read more

🇺🇸 Staking services aren’t securities according to SEC. 🔗 Read more

🇺🇸 US CLARITY Act digital asset legislation may leave non-native tokens as securities. 🔗 Read more

🇺🇸 Democrats to block Trump stablecoin due to conflict of interest. 🔗 Read more

🇺🇸 NYC comptroller slams mayor’s Bitcoin bond plan as 'fiscally irresponsible'. 🔗 Read more

🇪🇺 ECB sees crypto adoption growth but raises stability concerns. 🔗 Read more

🇬🇧 FCA consults on more relaxed stablecoin framework and crypto. 🔗 Read more

🇭🇰 After passing stablecoin legislation, Hong Kong consults on rules. 🔗 Read more

🇰🇷 South Korea becomes testing ground for central bank vs. stablecoin supremacy battle. 🔗 Read more

Institutional Moves in Tokenized Finance

Major moves in tokenized funds, banking adoption, and strategic expansion across digital assets, stablecoins, and infrastructure.

📊 Tokenized Funds & Infrastructure

Central African Republic to tokenize land using national Solana meme coin. 🔗 Read more

Euroclear integrates FundsPlace with Singapore’s DLT-based Fundnode. 🔗 Read more

🏦 Banking & Custody

Banco Santander mulls euro and dollar stablecoins. 🔗 Read more

Cantor Fitzgerald launches Bitcoin lending. 🔗 Read more

💼 Strategic M&A & Expansion

Conduit secured $36M in funding to expand stablecoin business. 🔗 Read more

BVNK partners Worldpay for stablecoin payouts. 🔗 Read more

Bergen County partners with Balcony for $240B property tokenization project. 🔗 Read more

Chart of The Week