Digital Asset Weekly #1: Dec 2, 2024

Memecoins and Utility, Digital Asset Market Optimism, and Germany’s Blockchain Adoption Challenges

Welcome to the First Issue of the Digital Asset Weekly!

This newsletter is your weekly roundup on crypto, digital assets, and DeFi. If you’re new to the space—or simply curious about its foundations—start with the following introductory article:

In this newsletter, you'll discover digital asset market updates, the latest news, actionable insights, and research highlights to keep you well-informed in the industry. Whether you’re a professional, an enthusiast, or just exploring, this is your place to stay ahead in the digital finance revolution.

Dive into this week’s highlights!

Key Takeaways

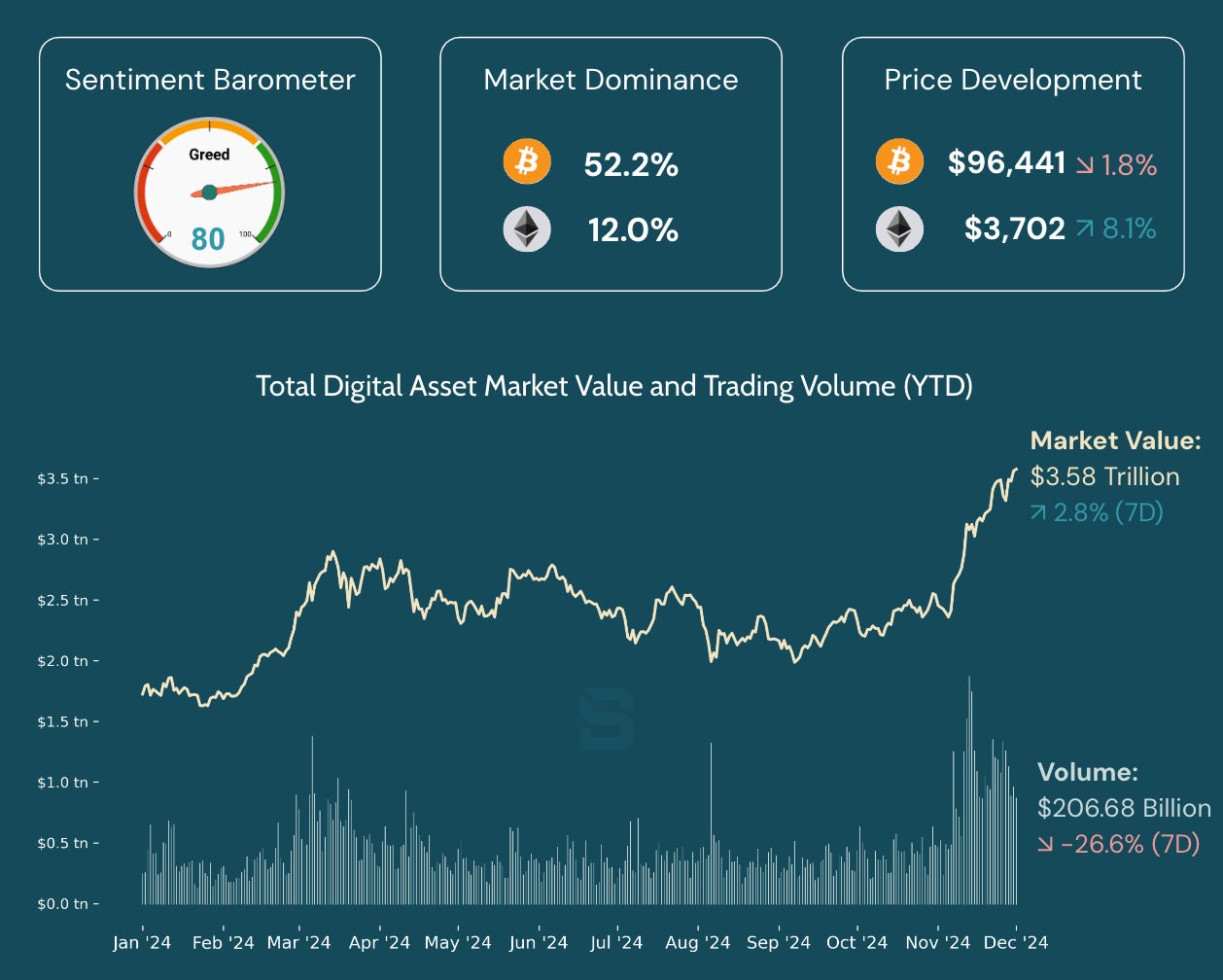

Alt Season Sparks Optimism: The market grew 2.8% to $3.58 trillion, while Bitcoin dominance dropped to 52.2%, and a Greed level of 80 signals sustained optimism.

Ripple’s Stablecoin Set for Approval: Ripple’s RLUSD stablecoin could launch soon, leveraging XRP for cross-border payments and addressing demand for trusted digital assets.

Memecoins Evolve Beyond Hype: Memecoins, up nearly 400% this year, are moving toward utility, driven by cultural influence and adoption by AI-powered communities.

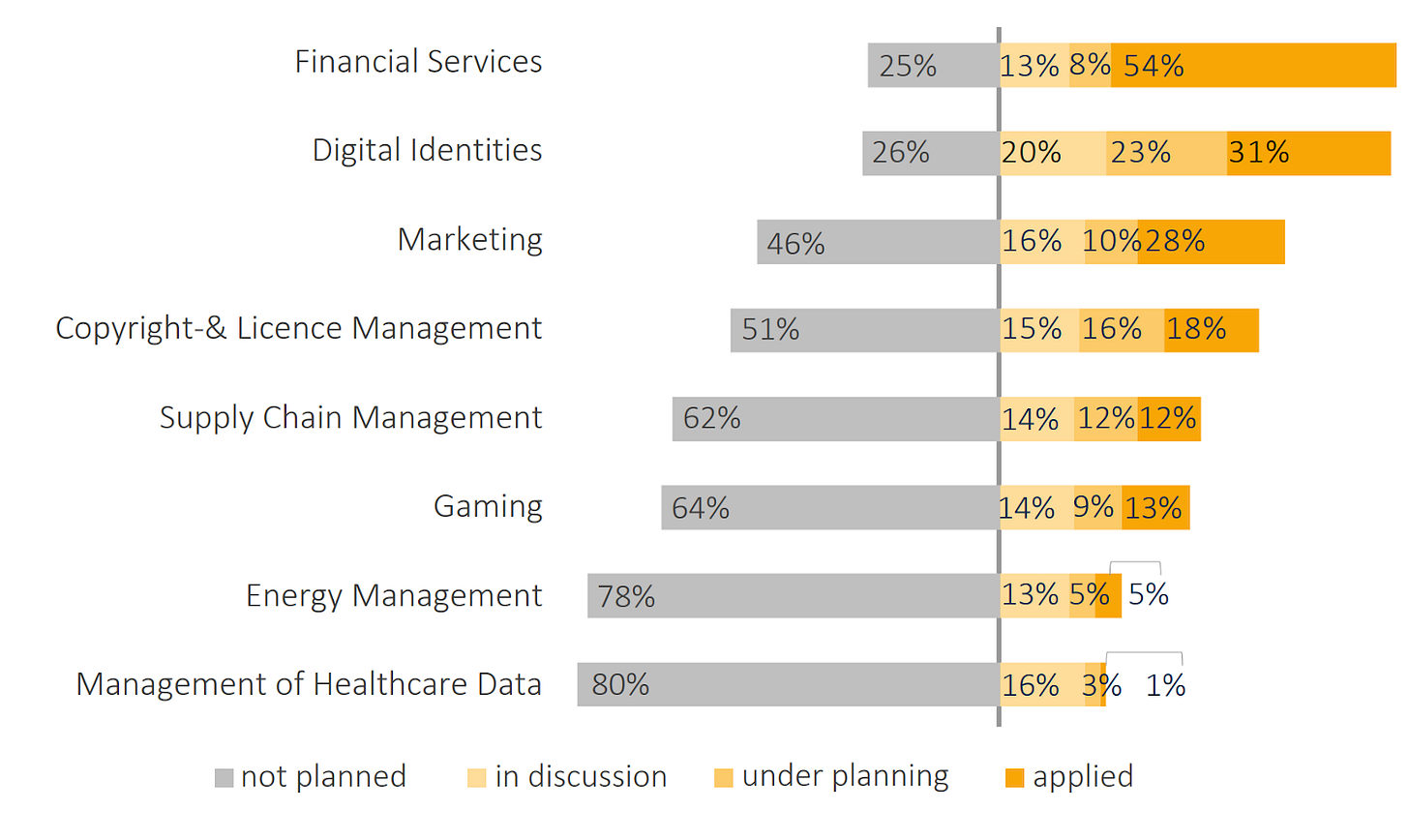

Germany’s Blockchain Barriers: Financial services lead blockchain adoption in Germany (54%), but regulatory uncertainty and usability issues hinder broader uptake.

Market Snapshot: Digital Asset Overview This Week (25 Nov – 1 Dec 2024)

This week, the digital asset market reached a total market value of $3.58 trillion, reflecting a 2.8% increase over the past 7 days, while trading volume declined 26.6% to $206.68 billion. Bitcoin holds a 52.2% dominance, priced at $96,441 (-1.8%), while Ethereum holds 12.0% dominance, priced at $3,702 (+8.1%). Bitcoin's dominance has decreased over recent weeks as many sell just below the $100,000 mark, while new retail investors enter the market, likely driving interest in alternative digital assets.

The Sentiment Barometer registers a Greed level of 80, signaling sustained market optimism despite mixed price developments.

Key Developments in Digital Finance

MicroStrategy’s Bitcoin Strategy Fuels Market Volatility

MicroStrategy, with over 386,700 BTC, has become a major force in the Bitcoin market. Its bold moves, like a $3 billion 0% debt issuance, are driving investor confidence and market volatility. While critics question its sustainability, MicroStrategy’s stock has outperformed Bitcoin by over five times this year.

Source: Forbes

Schwab Gears Up for Spot Crypto Trading

U.S.-based broker Charles Schwab is preparing to offer spot crypto trading once regulations allow, reflecting growing demand for digital assets. Schwab’s president anticipates regulatory changes soon, following the U.S. election. Currently, Schwab offers crypto-linked ETFs and futures, but plans are in place to expand.

Source: Ledger Insights

Ripple’s Stablecoin Nears Approval

The New York Department of Financial Services (NYDFS) is expected to approve Ripple’s RLUSD stablecoin, pegged to the U.S. dollar, by Dec. 4, 2024. Ripple aims to use RLUSD alongside its native cryptocurrency, XRP, in its cross-border payment solutions, addressing demand for stable, trusted digital assets. Testing on major blockchains like Ethereum has already begun.

Source: Cointelegraph

Trump’s Pick for SEC Chair Could Signal Crypto Shift

President-elect Trump’s team is considering Paul Atkins, a digital asset advocate and former SEC commissioner, to succeed Gary Gensler as SEC Chair. Known for supporting fintech innovation and lighter regulation, Atkins could signal a shift from Gensler’s enforcement-heavy approach. Trump’s campaign promises to end what he called an “anti-crypto crusade.”

Source: Yahoo Finance

Proposed Bitcoin Reserve Sparks Debate

A new bill proposes a “strategic bitcoin reserve” for the U.S., tasking the Treasury and Federal Reserve to hold one million BTC by 2045. Proponents argue it would diversify assets and boost resilience, while critics call it a "hodler's strategy," benefiting private investors more than the nation. Questions remain about its practicality and long-term impact.

Source: Financial Times

Focus: Memecoins Moving Toward Utility

Memecoins, often driven by community sentiment rather than intrinsic value, have soared nearly 400% this year, evolving from humorous tokens into cultural and financial phenomena. Initially known for their speculative nature, recent developments suggest a shift toward utility and innovation.

Key drivers include their role in fostering digital communities and their increasing adoption by AI-powered characters like “Fi”, whose memecoin concepts highlight the intersection of tech and fandom. Investors see memecoins as a starting point for new trends in digital assets and innovation, with some coins, like Dogecoin, gaining utility over time. However, exchanges like Binance emphasize due diligence to filter for memecoins with real use cases, signaling a maturation of the market.

For digital asset enthusiasts and investors, memecoins reveal opportunities to engage with a broader blockchain-based economy while raising awareness of the risks. They underscore the need for innovation that combines cultural value with real-world applications, paving the way for blockchain’s future role in finance.

Sources: Forbes, MarketVector, The Street, and TradingView

Research Highlight: Blockchain Adoption in Germany

A recent study reveals that 54% of blockchain use in Germany comes from financial services, where it powers secure transactions and liquidity solutions. Despite this, adoption outside finance remains limited—industries like digital identity (31%) and healthcare data (1%) show minimal uptake, signaling untapped potential for blockchain innovation.

The study identifies key barriers to adoption:

Blockchain’s association with cryptocurrencies overshadows its broader applications.

Ambiguous regulation discourages investment and experimentation.

Many businesses lack the expertise to implement blockchain effectively.

Why This Matters for Digital Finance

Blockchain’s success in financial services highlights its transformative potential for digital finance. From enhancing payment systems to creating more secure and transparent financial operations, blockchain is uniquely positioned to redefine how value is exchanged and verified. Addressing adoption barriers could unlock further use cases in areas like decentralized lending, identity management, and cross-border payments, driving efficiency and trust in financial ecosystems.

Germany’s limited adoption reflects broader global challenges in bridging innovation with practical implementation. To fully realize blockchain’s role in digital finance, the focus must shift to creating user-friendly, regulatory-compliant solutions that demonstrate clear value beyond speculative assets. By addressing these challenges, blockchain could become a cornerstone of a more inclusive and efficient digital financial future.

Enjoyed this post? Share it with your network or leave a comment below—I’d love to hear your thoughts!