Digital Asset Weekly #2: Dec 9, 2024

Bitcoin Hits $100K, U.S. Names AI & Crypto Chief, ChatGPT Outperforms in Market Predictions, and More!

Last week, Bitcoin's crossing of the $100,000 mark dominated the headlines. This is an important milestone that underscores the growing role of Bitcoin in finance. But that wasn’t the only highlight. Here's what else I cover in this issue:

Key drivers of Bitcoin's $100,000 milestone.

Aggregated digital asset market snapshot.

Top news, including the appointment of an AI and crypto chief in the US.

Insights from a research study on AI-driven trading strategies.

Enjoy reading!

If you haven’t subscribed yet, join now to stay ahead in digital assets, crypto, and DeFi.

Best,

Benjamin

Weekly Market Snapshot

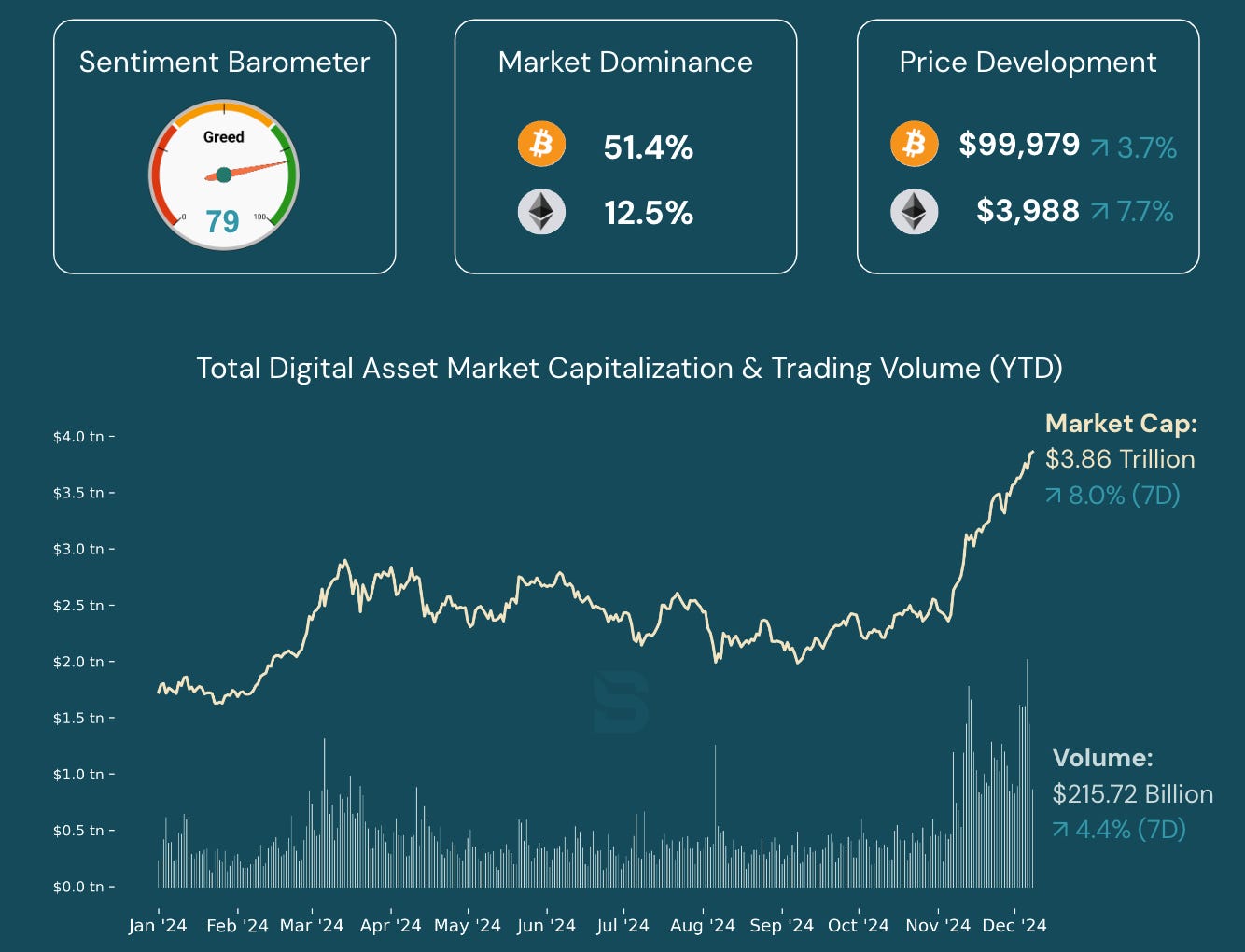

Bitcoin's milestone crossing of $100,000 this week fueled market optimism, driving the digital asset market capitalization up by 8.0% to $3.86 trillion. Between December 2 and 8, trading volume rose 4.4% to $215.72 billion, with Bitcoin gaining 3.7% to $99,979 and Ethereum surging 7.7% to $3,988. Market sentiment remains strong, reflected in a Greed level of 79.

Sources: Alternative.me, CoinGecko, and Defillama

Top News

Coinbase Ends Stablecoin Rewards

Coinbase ended its USDC stablecoin rewards program for European Economic Area customers on December 1, 2024, to comply with the EU’s Markets in Crypto Asset (MiCA) regulations on stablecoins. These rules ban interest-earning features and require stablecoin issuers to maintain reserves and e-money authorization. (Source: Decrypt)

Trump Names David Sacks as AI and Crypto ‘Czar’

President-elect Trump has appointed tech investor David Sacks as the “White House AI & Crypto Czar,” tasked with shaping U.S. policies on artificial intelligence and cryptocurrency. Sacks will lead efforts to establish a legal framework for crypto and oversee a presidential council on science and technology. (Source: CNBC)

Celsius Founder Admits to Fraud

Alex Mashinsky, founder and former CEO of Celsius Network, pleaded guilty to fraud charges, admitting to misleading customers and manipulating the price of CEL, the platform's token. Mashinsky personally profited $42 million while customers suffered losses when Celsius filed for bankruptcy in 2022. He faces up to 30 years in prison, with sentencing set for April 2025. (Source: Reuters)

British Law Enforcement Uncovers Global Money Laundering Network

The British National Crime Agency (NCA) uncovered a global money laundering network that used Russian crypto services to convert UK drug profits into untraceable cryptocurrencies. Spanning over 30 countries, the operation also supported Russian espionage efforts. The NCA seized £20 million in cash linked to £700 million in drug sales and made 84 arrests. (Source: BBC)

Coinbase Integrates Apple Payment

Coinbase exchange enables cryptocurrency purchases for over 60 million U.S. users via Apple Pay in third-party apps. The integration simplifies onboarding and promotes accessibility for blockchain adoption. It offers guest checkouts, free on-and-off ramping for USDC, and various payment options for a faster, more accessible experience. (Source: Yahoo Finance)

In Focus

Bitcoin Hits The $100,000 Mark

Bitcoin crossed the $100,000 mark this week, an important milestone in its evolution as a financial asset. This achievement follows its increase to $71,000 earlier in 2024, building on a history of key price surges, including $1,000 in 2013 during early adoption, $18,000 in 2017 amid the Initial Coin Offering (ICO) boom, and $66,000 in 2021 as institutional interest grew.

In 2024, several factors played a role in driving Bitcoin’s rise:

The approval of the spot Exchange Traded Funds (ETFs) early in the year allowed both retail and institutional investors to gain regulated exposure to digital assets.

Corporates, such as Microstrategy, sought to build strategic digital asset allocations.

The pre-programmed halving event in mid-2024 reduced Bitcoin’s supply.

Optimism following the election of a pro-crypto U.S. administration supported positive sentiment.

Recent discussions positioned Bitcoin as a potential strategic reserve asset for sovereign investors.

Bitcoin’s declining volatility and strong returns have made it an attractive option for portfolio diversification.

All these factors combined have pushed Bitcoin to the $100,000 mark. While this milestone underscores Bitcoin’s growing acceptance, it raises questions about the sustainability of its valuation and the strength of its market fundamentals.

Sources: CBS News and CoinMarketCap

Want to find out more exclusive insights behind Bitcoin’s $100k milestone? In my latest analysis, I dive into the market fundamentals driving this rise—plus what they mean for its sustainability. You can read my free special report here:

Research Spotlight

AI Outperforms in Digital Asset Market Trading

A recent study examined the effectiveness of AI-driven trading strategies in predicting Bitcoin price movements. Two approaches were tested from January 2018 to September 2023 and compared to the traditional Buy and Hold strategy:

The ChatGPT 01-Preview strategy, which combined multiple technical indicators with sentiment analysis. This strategy achieved a total return of 944.85%.

The second strategy is using the Extreme Gradient Boosting technique. This strategy delivered a return of 189.05%.

Conversely, the Buy and hold strategy yielded just 73.08%, significantly underperforming its AI-driven counterparts. Moreover, ChatGPT 01-Preview’s excess return of 755.8% over XGBoost demonstrates the potential of AI to leverage diverse data sources like social media for higher predictive accuracy compared to relying solely on economic data.

Why This Matters

The study sheds light on the transformative potential of AI in financial markets, particularly in harnessing multiple data sources, such as market sentiment, for more accurate and timely predictions. For digital asset traders and investors, these findings underscore the value of integrating AI tools to optimize returns. As such, AI has the potential to redefine conventional market strategies and risk management practices.

Source: Finance Research Letters

Enjoyed this issue? Share it with your network or leave a comment below—I’d love to hear your thoughts!