Digital Asset Weekly #3: Dec 16, 2024

Bitcoin Holds Above $100K, El Salvador Shifts Crypto Policy, AI Agents Reshape Digital Finance, And More!

Welcome to the latest insights into Digital Finance!

The past week saw some shifts in the industry. While Bitcoin edged higher and market sentiment held strong, a broader market pullback highlighted ongoing price volatility. Meanwhile, AI's growing role in crypto takes center stage, alongside developments shaping institutional adoption and global policies.

In this issue, I cover:

How AI agents are transforming digital finance and crypto interaction.

Why cryptocurrency arbitrage trading often falls short of profitability.

Key industry developments, including MicroStrategy’s inclusion in the Nasdaq-100.

This week’s digital asset market snapshot.

Enjoy reading!

If you haven’t subscribed yet, join now to stay ahead in digital finance.

Best,

Benjamin

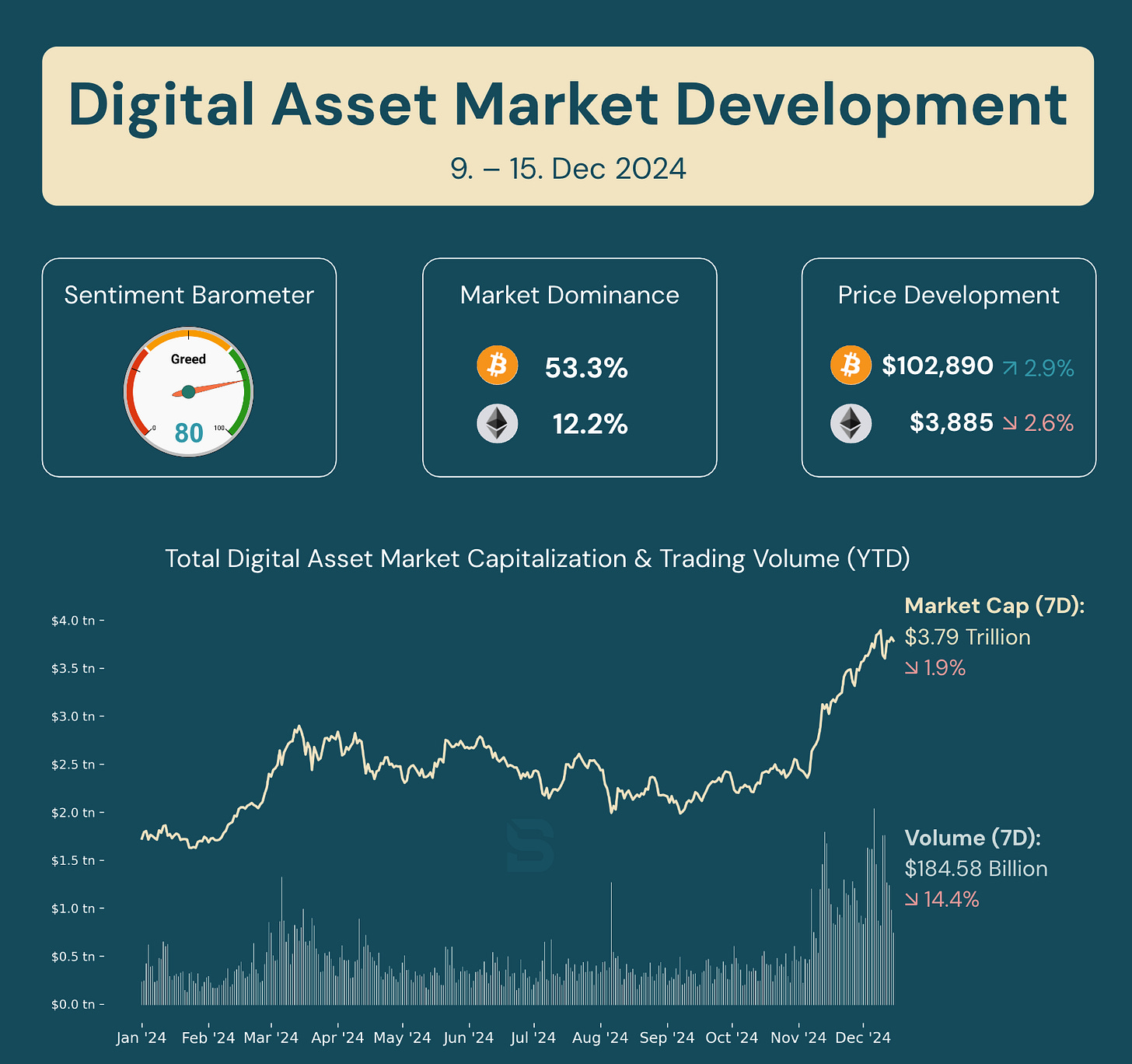

Market Overview: Digital Asset Trends This Week

After a strong week, the digital asset market saw a slight pullback this week. Between December 9 and 15, total market capitalization decreased by 1.9% to $3.79 trillion, while trading volume dropped 14.4% to $184.58 billion. Bitcoin edged up 2.9% to $102,890, while Ethereum declined 2.6% to $3,885. Notably, Bitcoin's dominance rose slightly to 53.3%, reflecting its relative strength amid broader market cooling. Market sentiment remained in the greedy zone, rising to 80, signaling cautious optimism.

Sources: Alternative.me, CoinGecko, and Defillama

Missed my analysis of Bitcoin's $100K milestone? I break down the fundamentals and its sustainability. Read it for free!

Top News: Microstrategy, BlackRock, and Crypto Updates

Bitcoin Corporate Joins Nasdaq Index

MicroStrategy will be added to the Nasdaq-100 Index on December 23, 2024, following a six-fold increase in its stock price this year. The company, now the largest corporate holder of bitcoin with 423,650 BTC, has benefited from rising crypto prices, boosting its market value to nearly $94 billion. Analysts view this milestone as enhancing the company’s visibility and positioning it for potential S&P 500 inclusion in 2025.

→ Read the full article here: Reuters

BlackRock Recommends Bitcoin Allocation of Up to 2%

BlackRock has suggested investors consider allocating up to 2% of their portfolios to Bitcoin. The U.S.-based asset manager highlights Bitcoin’s portfolio diversification benefits but also warns about it’s price fluctuations and adoption trends. BlackRock’s Bitcoin ETF, launched in January 2024, now manages $51.1 billion in assets, accounting for 2.5% of all Bitcoin supply.

→ Read the full article here: Reuters

El Salvador Scales Back Bitcoin Policy for IMF Deal

El Salvador is set to make Bitcoin acceptance voluntary instead of mandatory to secure a $1.3 billion IMF loan and additional funding from international lenders. While President Nayib Bukele’s Bitcoin policies gained attention, most citizens still prefer the U.S. dollar. This shift aims to stabilize the economy and address fiscal challenges while maintaining Bitcoin reserves worth over $600 million.

→ Read the full article here: Financial Times

Binance and Circle Join Forces to Challenge Tether

Crypto exchange Binance and stablecoin issuer Circle have announced a strategic partnership to promote USDC in order to capture a larger share of the stablecoin market currently dominated by U.S. competitor Tether. This collaboration leverages Binance’s extensive network and Circle’s regulatory credibility. The partnership marks Binance’s return to the stablecoin market, now aligned with Coinbase as a co-owner of USDC.

→ Read the full article here: Yahoo Finance

AI Agents in Crypto: Transforming Digital Finance

AI agents are emerging as a transformative innovation in the cryptocurrency sector, offering ways to simplify tasks, enhance efficiency, and improve decision-making in a fast-evolving landscape. As these systems gain traction, they are reshaping how users interact with digital assets and blockchain technology.

What Are AI Agents and How Are They Used?

AI agents are self-operating software programs that adapt, make decisions, and execute tasks independently.

Unlike traditional automation tools like chatbots, these agents utilize advanced learning algorithms to solve complex scenarios dynamically, making them ideal for the fast-paced cryptocurrency ecosystem.

Users rely on AI agents for tasks like managing portfolios, executing trades, and optimizing blockchain payments. For example, VaderAI autonomously analyzes market trends and manages investments, while Virtuals facilitates tokenized governance functions. Similarly, Tokenbot allows users to deploy and manage tokens seamlessly.

Opportunities and Challenges

AI agents are driving innovation in decentralized finance (DeFi), payments, and digital services. They pave the way for decentralized hedge funds, automated trading, and personalized financial tools, creating new economic models that boost user engagement and generate revenue. By enabling tokenized and co-owned agents, these systems foster user-driven ecosystems.

However, significant challenges remain: blockchain scalability, limited interoperability, and trust in AI outputs. Additionally, integrating AI agents seamlessly into blockchain environments demands robust technical solutions. Addressing these barriers is crucial for unlocking their full potential.

Why This Matters

AI agents are poised to revolutionize digital finance by improving accessibility, automation, and decision-making. As they evolve, they could play a pivotal role in shaping DeFi's future. However, addressing technical and trust-related challenges will be vital for their broader adoption and effectiveness. Understanding their potential and challenges, users can better prepare for the transformative impact these technologies may have on the next stage in the evolution of digital finance.

→ Read more here: Bankless, Binance, and Cointelegraph

Research Spotlight: Cryptocurrency Arbitrage Inefficiencies

A recent study explored how efficient the cryptocurrency markets are by examining triangular arbitrage, a type of trading strategy in which traders try to profit from price differences between three financial assets. The researchers found 4,879 potential opportunities with Bitcoin, Litecoin, and the US dollar during a single week. However, real-world challenges like transaction fees and limited trading volumes resulted in almost all trading opportunities being unprofitable.

The results suggest that centralized cryptocurrency markets are highly efficient despite small, temporary price differences. Importantly, simply identifying arbitrage opportunities does not mean that they can actually be exploited for profit.

Why this is important

For traders and investors, this study shows that while digital asset markets may sometimes appear inefficient, very often real factors eliminate these opportunities. By understanding these dynamics, market participants can focus on setting realistic expectations and adopting strategies that are better suited to the complexities of cryptocurrency trading.

→ Explore the full study here: Finance Research Letters