Digital Asset Weekly #4: Dec 23, 2024

Bitcoin's New High Followed by a Market Pullback, New Crypto ETF Approved, U.S. Policy Changes Shake Markets, And More!

The past week was marked by Bitcoin's all-time high crossing $108K, followed by a sharp downturn as shifts in U.S. monetary policy unsettled markets. Meanwhile, the approval of a new crypto ETF and key institutional moves signal evolving adoption trends.

In this issue, I cover:

The Fed’s interest rate cut, its impact on crypto markets, and what’s next.

Bitcoin’s spending patterns and what coin age reveals about investor behavior.

Top news like MicroStrategy’s leadership updates and new ETFs.

This week’s digital asset market snapshot.

If you haven’t subscribed yet, now’s the perfect time—unlock premium insights with my special Christmas offer, available until December 26!

Wishing you a wonderful holiday season and Merry Xmas!🎄

Market Overview: Digital Asset Snapshot Past Week

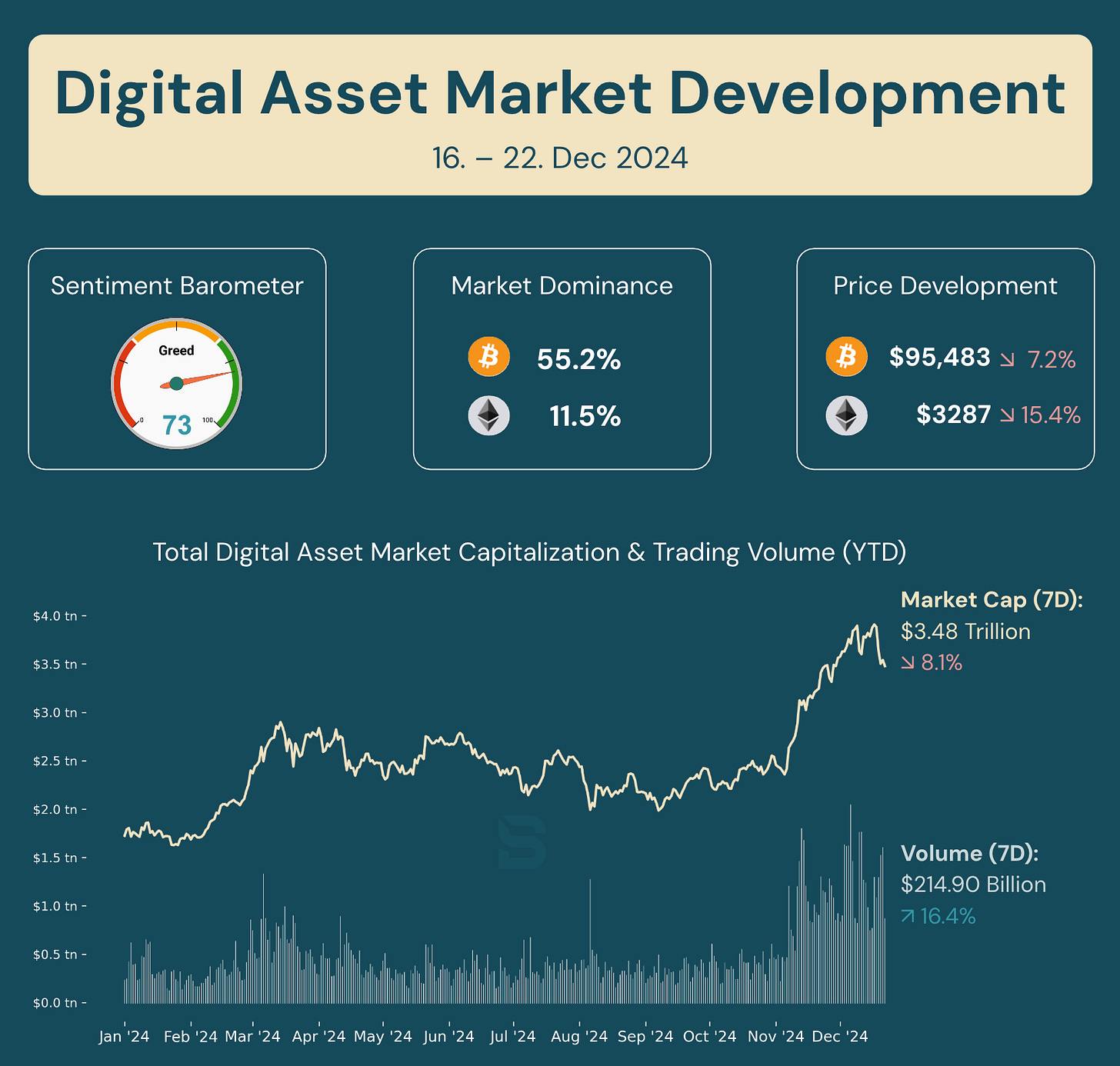

This week, the digital asset market experienced a sharp decline. Between December 16 and 22, total market capitalization dropped by 8.1% to $3.48 trillion, accompanied by a significant increase in trading volume, rising 16.4% to $214.90 billion. Bitcoin fell by 7.2% to $95,483, while Ethereum saw a steeper decline, losing 15.4% to $3,287. Bitcoin's dominance increased slightly to 55.2%, highlighting its relative resilience amid the broader market downturn. Market sentiment dipped but remained in the greedy zone at 73, reflecting cautious optimism despite the sell-off.

Sources: Alternative.me, CoinGecko, and Defillama

Overwhelmed by crypto jargon? Start with my Digital Assets 101 Guide and build your foundation today! Read the guide here:

Top News

New Crypto ETF, Microstrategy’s Board Update, and More

SEC Approves First Bitcoin-Ether Combo ETFs

The SEC approved the first ETFs combining Bitcoin and Ether spot assets from Hashdex and Franklin Templeton. Scheduled for launch in January, these funds offer diversified exposure, with 80% in Bitcoin and 20% in Ether. Industry analysts expect strong demand for these ETFs in the next year.

→ Read the full article here: Yahoo Finance

Former Binance.US CEO Joins MicroStrategy Board

Michael Saylor's MicroStrategy has expanded its board of directors, adding former Binance.US CEO Brian Brooks and two other executives. Brooks, once rumored to replace SEC Chair Gary Gensler, brings deep regulatory experience, having served as the U.S. Comptroller of the Currency.

→ Read the full article here: Cointelegraph

Tether Faces Scrutiny Over Treasury Holdings

The Financial Stability Oversight Council (FSOC) highlighted risks tied to Tether's opaque reserve practices, noting the stablecoin's $120 billion market cap dominates 70% of the sector. Unlike competitors like Circle, Tether has not disclosed detailed information about its U.S. Treasury holdings. The FSOC warns this lack of transparency could pose risks to crypto and traditional markets if Tether were to face financial instability.

→ Read the annual report here: FSOC

More News:

Deutsche Bank Unveils Ethereum Layer-2 Network

→ Read the full article here: CoinDesk

Ripple's RLUSD Stablecoin Launch Sparks Early Premiums

→ Read the full article here: Yahoo Finance

Ethena Labs Introduces BlackRock-Backed Stablecoin USDtb

→ Read the full article here: Crypto Briefing

Germany Passes Financial Market Digitization Law

→ Read the summary (German only) here: German Bundestag

This Week’s Focus

The Fed’s Interest Rate Cut: Impacts on Crypto and Financial Markets

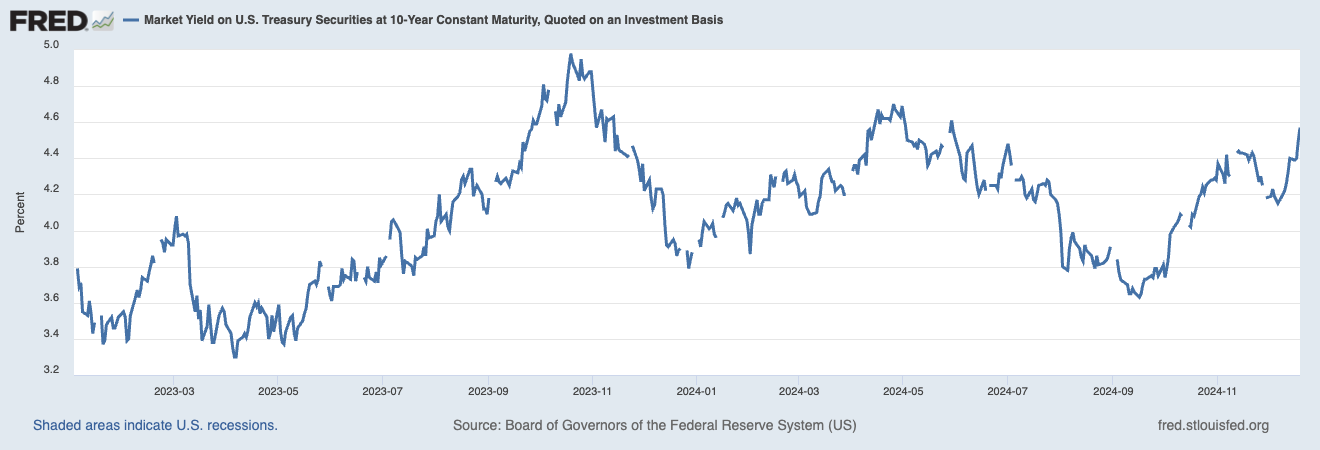

Last week, the U.S. Federal Reserve (Fed) cut interest rates by 25 basis points (i.e., 0.25%), bringing the target range to 4.25%-4.5%. This marked the third rate reduction since September, aimed at addressing mixed economic signals, including rising unemployment and slowing inflation. However, this move came with a cautious outlook for 2025, with the Fed signaling only two additional rate cuts next year—far fewer than previously anticipated.

What This Means for Financial Markets

The Fed’s cautious approach has created uncertainty across financial markets, including digital assets. Rate cuts often stimulate the economy by lowering borrowing costs, encouraging spending, and making riskier assets like stocks more attractive. However, the Fed's cautious guidance dampened investor optimism. The S&P 500 index fell 2.9%, and Bitcoin saw a sharp decline, dropping from an all-time high of $108,000 to below $100,000.

What Already Happened?

Bond Yields Rose: Despite the rate cut, long-term bond yields increased, reflecting concerns over government debt and inflation expectations.

Crypto Declines: Bitcoin dropped 5%, trading near $98,000, with Ethereum and XRP following suit. The broader digital asset market lost 7% in capitalization as investors de-risked their portfolios.

Equity Volatility: Stocks also took a hit as the Fed’s hawkish guidance unsettled markets, overshadowing the immediate benefits of the rate cut.

Five Scenarios for Digital Asset Markets

The Fed's rate cuts and cautious 2025 outlook create a mixed environment for digital assets. There are five different scenarios that could impact crypto markets negatively or positively. Here's what could happen next:

Higher Bond Yields: Rising yields could divert funds from non-yielding assets like digital assets to safer bonds. (Negative)

Liquidity Increases: Lower rates may inject liquidity, supporting speculative assets like digital assets. (Positive)

Inflation Concerns Persist: Bitcoin may attract investors as a hedge against inflation, but uncertainty could deter broader market participation. (Mixed)

Cautious Fed Guidance Continues: A slow pace of rate cuts could weigh on risk assets, keeping crypto prices subdued in the short term. (Negative)

Broader Adoption Narratives: Digital assets could benefit from narratives of decentralization, especially as concerns about traditional financial systems grow. (Positive)

While rate cuts could inject short-term liquidity, the long-term impact will depend on how inflation, government debt, and risk sentiment evolve. Digital asset markets face both headwinds and opportunities, with their role as an alternative asset class under the spotlight.

→ Read more here: Crypto Briefing, Decrypt, Federal Reserve Economic Data (FRED), Markets Insider, and The Motley Fool

Research Highlight

How Bitcoin’s Coin Age Influences Spending Patterns and Investor Behavior

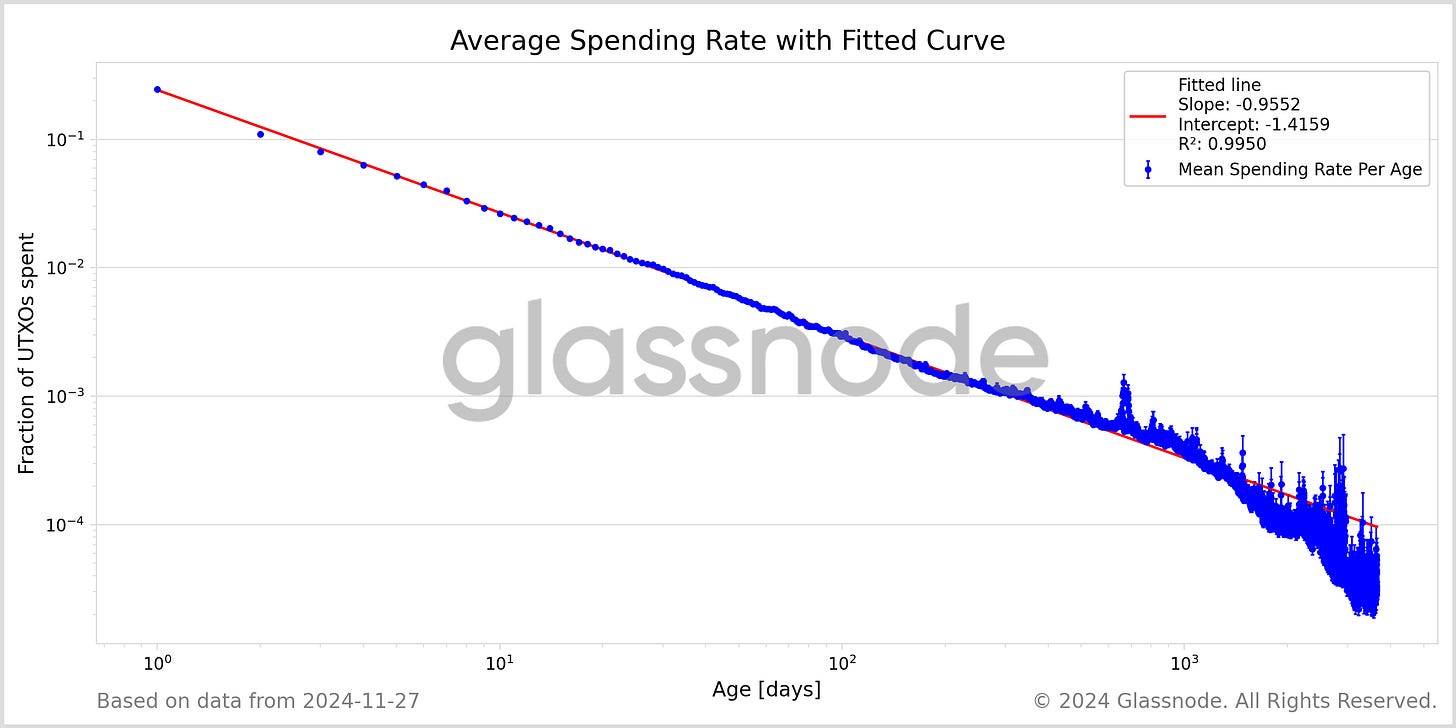

Understanding Bitcoin’s lifecycle is key to decoding market behavior, and a new study by Glassnode’s research team sheds light on how a coin’s age impacts its spending likelihood. The study reveals an interesting power-law dynamic: the older a coin gets, the less likely it is to be spent. This finding provides a predictive framework to better understand investor habits and digital asset dormancy.

What Was Analyzed?

Using data from 2015 to 2024, researchers examined the Unspent Transaction Outputs (UTXOs) of Bitcoin, which track unspent coins. They measured the probability of these UTXOs being spent based on their age, finding a consistent pattern where spending declines predictably over time. For example, coins aged 3 days have a 10% likelihood of being spent, while coins aged 300 days have just a 0.1% chance.

Key Findings

Power-Law Behavior: Coins younger than 200 days are actively traded, transitioning to long-term holding after this period.

Long-Term Holders: Coins older than four years are rarely spent, with deviations indicating strong holding convictions or lost coins.

Predictive Accuracy: A heuristic assuming coins under seven days are "hot" (likely to be spent) achieves a 98% prediction accuracy.

Why This Is Important

This study enriches on-chain analytics by complementing short-term and long-term holder frameworks with a continuous perspective. The findings help investors and analysts:

Anticipate liquidity shifts by understanding when coins are likely to re-enter circulation.

Refine on-chain analysis with a precise, data-driven approach.

Gain deeper insights into Bitcoin’s ecosystem and holder behavior.

In an evolving digital asset market, such insights provide a vital edge for making informed decisions and understanding cryptocurrency’s economic dynamics.

→ Explore the full research analysis here: Insights Glassnode