Year-End Special: Digital Asset Highlights & 2025 Outlook

Crypto's 2024 Milestones and Nine Key Theses for Digital Assets in 2025

2024 has been historic for the digital asset industry, with Bitcoin reaching an all-time high of $100K, stablecoins breaking records in transaction volume, and a pro-crypto sentiment following the U.S. election. In this year-end special edition, I cover:

Key moments that defined crypto in 2024.

My outlook for 2025 with nine trends and factors that will shape the digital asset industry.

A snapashot of this year’s digital asset market performance.

Looking ahead to 2025, I’d like to share my vision and goals with you:

My vision is to empower everyone with a clear understanding of crypto and DeFi as key elements of digital finance—their significance, potential, and challenges. To achieve this, I follow three guiding principles:

Bridging traditional and digital finance to create a cohesive understanding of modern finance.

Delivering objective, evidence-based insights driven by data and facts.

Simplifying complexity to make these topics accessible to all.

Building on this foundation, I’ve set three ambitious goals for 2025:

Grow this community to 5,000 subscribers—creating a vibrant, engaged network for professionals and enthusiasts to connect and learn.

Establish myself as a leading voice in digital finance—recognized for a balanced stance on digital assets and DeFi while providing clear, evidence-based insights.

Expand my social media presence and Launch a YouTube channel—to inform, educate, and demystify topics around crypto, DeFi, and blockchain for a wider audience.

With your support, we can make digital finance more accessible and engaging for everyone.

Here’s how you can help:

Subscribe to stay informed.

Share this newsletter with others who might benefit from these insights.

Engage by leaving a like or comment with your thoughts this year-end edition.

Thank you for trusting my work!

I wish you a successful and prosperous New Year!

Benjamin

2024 Year-End Digital Asset Market Performance Overview

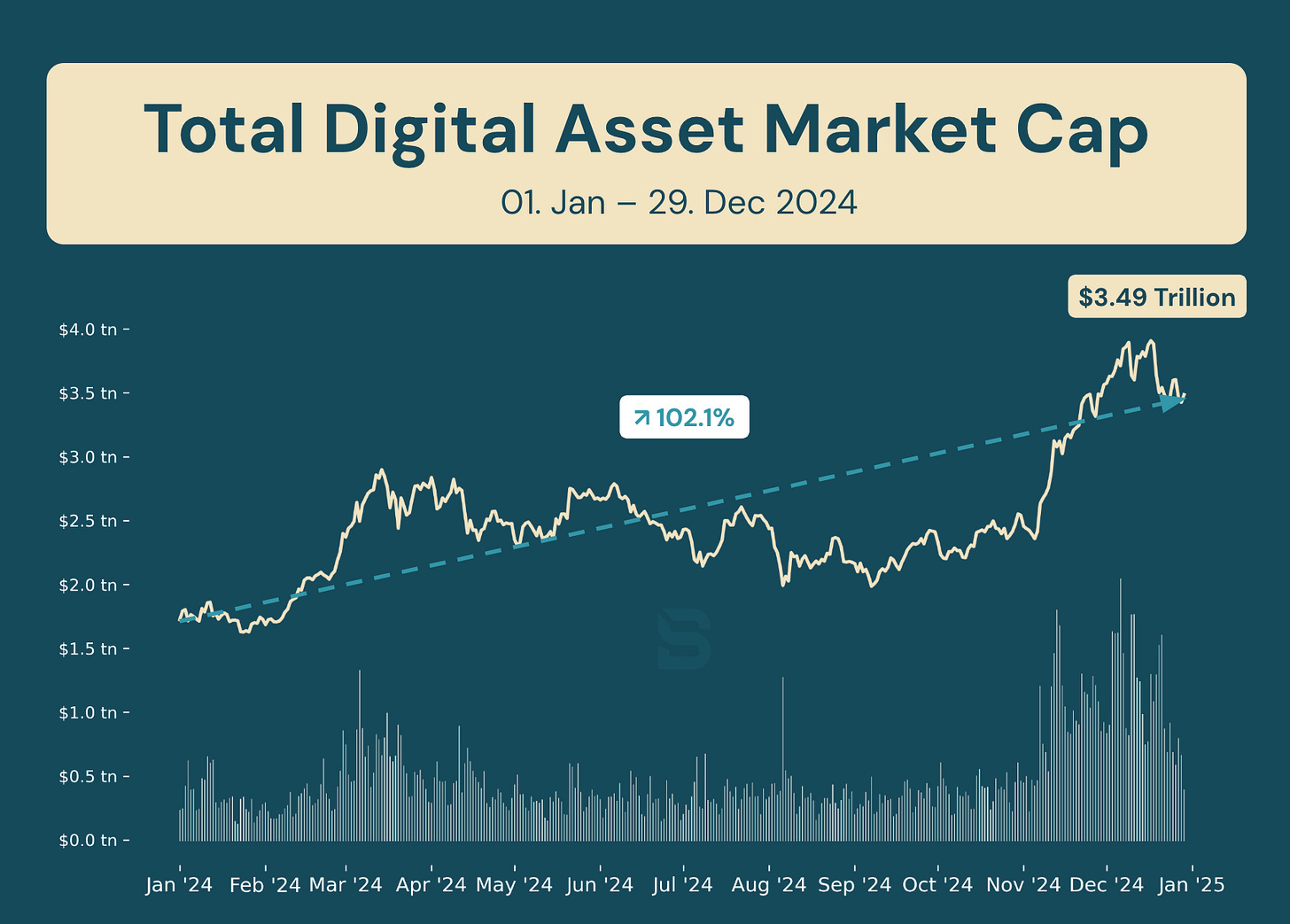

By the end of 2024, the digital asset market demonstrated significant growth, with total market capitalization surging 102.1% year-to-date to $3.49 trillion. Trading volumes notably increased in March following the Bitcoin and Ethereum ETF approvals early in the year and spiked again in November after the U.S. election, as shown in the chart. This robust performance highlights significant recovery and increased investor activity throughout the year, underscoring 2024 as a transformative year for the digital asset industry. (Source: CoinGecko)

2024 In Review

A Year of Milestones for The Digital Asset Industry

Let’s first recap the pivotal moments that defined the digital asset industry in 2024:

Spot ETF Approvals: The approval of spot Bitcoin and Ether ETFs in the U.S. transformed market accessibility, drawing record institutional inflows and legitimizing digital assets as part of mainstream finance.

Corporate Investments: Major firms ramped up their participation in digital assets, with companies like MicroStrategy and BlackRock leading the charge, further cementing crypto’s role in corporate strategies.

Bitcoin Halving Impact: The Bitcoin halving in April 2024 heightened scarcity and drove market enthusiasm, contributing to a significant price rally and reinforcing Bitcoin’s role as a store of value.

Bitcoin Hits $100K: Bitcoin surpassed the $100,000 milestone in December 2024, fueled by spot ETF inflows, institutional adoption, and the post-halving supply shock, solidifying its status as a premier digital asset. I delved into the key factors behind Bitcoin’s milestone and provided a balanced analysis of its market fundamentals. Read the full analysis here:

Pro-Crypto Sentiment Post-U.S. Election: The election of a pro-crypto administration set the stage for a friendlier regulatory environment, boosting investor confidence in the industry’s long-term potential.

High Returns in 2024: Digital assets delivered exceptional performance, with Bitcoin gaining over 120% during the year, outperforming most traditional asset classes. Broader digital asset markets also posted strong returns, buoyed by institutional inflows and renewed investor confidence.

Stablecoin Growth: Stablecoins saw their market capitalization rise 50% to $193 billion, processing over $27 trillion in transactions YTD, driven by expanding use cases in payments and commerce.

Tokenization Progress: Real-world asset tokenization grew by 60% to $13.5 billion, with adoption spreading to private credit, real estate, and corporate bonds.

DeFi Resurgence: Total Value Locked (TVL) in DeFi protocols hit an all-time high of $93 billion, driven by record lending activity and rising trading volumes.

AI-Driven Crypto Innovation: AI-enabled applications like "AI Agent Coins" opened new possibilities for integrating autonomous intelligence into the crypto ecosystem.

Overall, these milestones underscore the evolution of the digital asset industry in 2024, paving the way for 2025.

Outlook for 2025

Nine Theses For Crypto Markets and Blockchain

As we enter 2025, I’ll share my nine theses for the digital asset industry. These expectations reflect the pivotal trends I believe will shape next year—from regulatory shifts and increasing institutional adoption to new milestones in stablecoins and tokenized real-world assets. Here’s my take on what’s driving digital assets in 2025.

Stablecoins have emerged as a cornerstone of the digital asset ecosystem, with market capitalization soaring 50% in 2024 to $193 billion and transactions exceeding $27 trillion YTD. Analysts project potential growth to $3 trillion in market value within five years, driven by expanding use cases beyond trading to global commerce and capital flows. Innovations and competition, including partnerships like Circle and Binance, are expected to challenge Tether’s dominance and reduce systemic risks. As tokenized dollars gain traction, stablecoins could revolutionize payments while bridging traditional finance and DeFi.

Tokenization of real-world assets (RWAs) grew by 60% in 2024, reaching $13.5 billion in value. Applications extend beyond U.S. Treasuries to private credit, commodities, corporate bonds, and real estate. Major players like BlackRock and Hashnote are advancing tokenized products, enhancing collateralization and liquidity. While challenges persist, sustained investment and regulatory clarity could cement RWAs as a pillar of the digital asset economy. The long-term vision of streamlined, fully onchain portfolio management is taking shape, promising to redefine traditional asset markets.

The approval of spot Bitcoin ETFs in 2024 marked a turning point, with institutional adoption accelerating. Bitcoin and Ether are gaining traction among private banks, hedge funds, and pension funds, with portfolio allocations increasingly seen as essential. Macro factors, including eased monetary policy and inflationary pressures, may further boost demand. Despite cryptos’ stark price fluctuations, their integration into traditional finance continues to deepen, paving the way for broader adoption of crypto ETFs and related financial products.

Spot Bitcoin and Ether ETFs reshaped digital asset investing in 2024, attracting over $110 billion and $12 billion in assets under management, respectively. These funds simplify access to digital assets for institutional and retail investors alike. Regulatory changes, such as incorporating staking and in-kind redemptions, could enhance ETF appeal in 2025. While Bitcoin continues to dominate flows, Ethereum is gaining momentum, supported by its role in tokenized assets and DeFi. ETFs are expected to remain a key driver of market growth and liquidity.

DeFi is undergoing a resurgence, with lending protocols and decentralized exchanges achieving record activity levels. Innovations like liquid staking are unlocking new use cases, driving collateralization and liquidity. Layer-2 solutions are enabling broader blockchain adoption, while regulatory developments may further integrate DeFi into traditional finance. Stablecoins continue to underpin the ecosystem, providing stability and liquidity. Despite regulatory scrutiny, DeFi’s expanding utility positions it as a critical component of the crypto landscape in 2025.

AI is transforming the digital asset sector, from partnerships with Bitcoin miners to scalable, always-on payment solutions. AI-enabled crypto applications, such as "AI Agent Coins," are creating innovative niches in finance, art, and culture. These developments mirror the NFT boom of 2021–22, suggesting transformative potential. As AI tools integrate further into digital asset markets, they promise to optimize efficiency, enable new use cases, and redefine user experiences.

The U.S. regulatory outlook is brightening, with bipartisan support and new Securities and Exchange Commission (SEC) leadership poised to end years of adversarial policies. Anticipated legislation on stablecoins and digital asset frameworks, along with closer SEC and Commodity Futures Trading Commission (CFTC) collaboration, could spur innovation and adoption. Globally, G20 nations are crafting clearer digital asset regulations (such as the Market in Crypto Asset Regulation, MiCAR, in the European Union), fostering confidence and participation. While pro-crypto policies may take time to materialize, the shift from enforcement to legislation signals a more supportive environment for digital assets.

The idea of Bitcoin reserves is gaining momentum, particularly at the state level, with Pennsylvania and Texas introducing enabling legislation. While a federal reserve remains speculative, a state-led approach could serve as a proof of concept. Advocates argue such reserves could position Bitcoin as a strategic asset akin to digital gold, driving global competition. As institutional interest in Bitcoin grows, its role as a decentralized store of value continues to evolve, underscoring its strategic importance.

Macroeconomic conditions in 2025 present a mixed outlook for digital asset markets. Persistent inflation, high bond yields, and tightening liquidity may limit crypto assets’ upside, while policy shifts under the new U.S. administration introduce uncertainty. However, easing interest rates and pro-crypto initiatives offer support, alongside crypto’s appeal as an inflation hedge. With rising geopolitical tensions and economic headwinds, alternative assets like Bitcoin could attract investors seeking resilience in an evolving financial landscape.

Looking Ahead to 2025

2025 promises to be a pivotal year for digital assets. Stablecoins, tokenization, and DeFi resurgence are expanding use cases, while institutional adoption and pro-crypto regulations drive further legitimacy. However, macroeconomic uncertainties like inflation and geopolitical tensions may test market resilience. As both a hedge and an innovation driver, digital assets remain a key focus.

I’m excited to see what 2025 will bring to digital assets.

Sources: Coinbase, Fidelity, Finance Magnates, Forbes, Markets Insider, Morningstar, Nasdaq, TradingView, and Yahoo Finance