Digital Asset Weekly #2: Jan 20, 2025

Trump's Meme Coin Rally, USDC’s Global Impact, Bitcoin-Backed Loans, and More!

This week was full of surprises in the digital asset space, from volatile markets to Meme coin mania. In this issue, I cover:

Trump’s Meme coin launch.

Coinbase’s launch of Bitcoin-backed loans.

Stablecoin’s growing role in global finance

This week’s digital asset market briefing.

Enjoy reading!

Best,

Benjamin

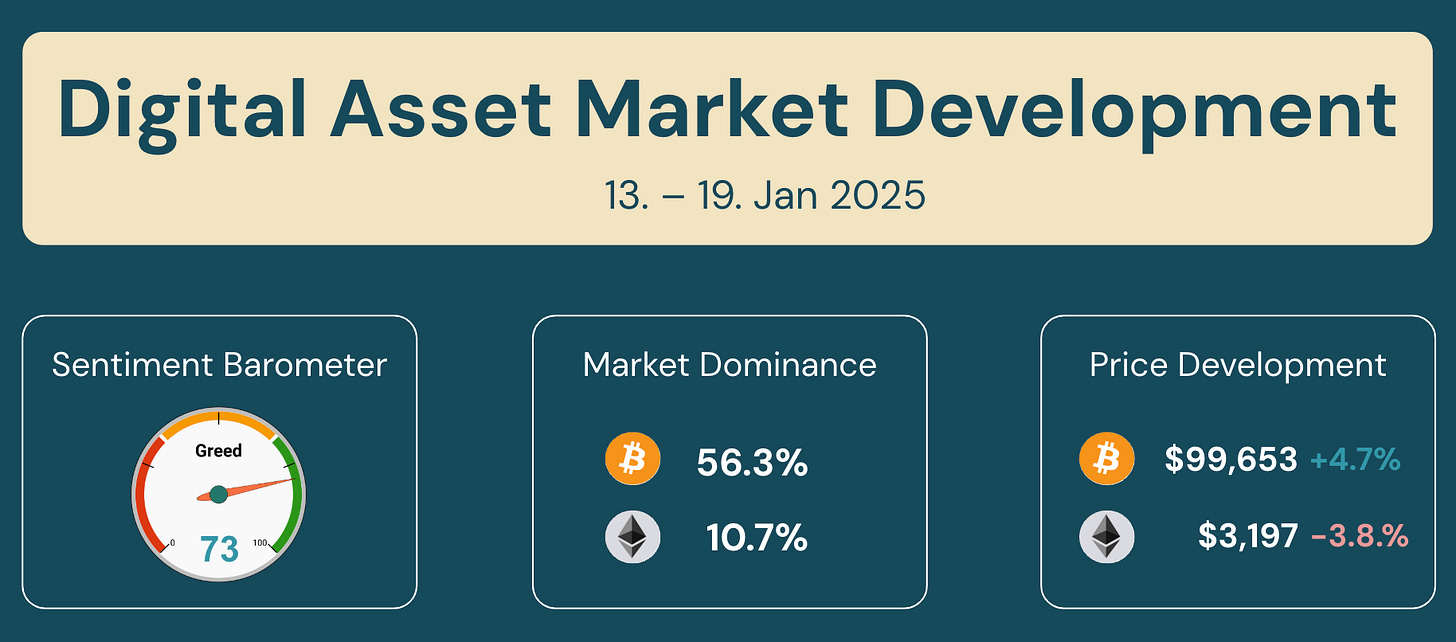

Digital Asset Market Briefing

While the Christmas season and the first days of 2025 felt calm, the past week brought a rollercoaster of volatility to the crypto market. Bitcoin dipping below $90,000 at the beginning of the week, driven by inflation concerns and reduced expectations of Federal Reserve interest rate cuts. Adding to the pressure were strong U.S. job data and rising bond yields, which heightened fears of persistent inflation and kept investors on edge.

Midweek, market sentiment climbed to 73 as a lighter-than-expected inflation report revealed a modest 0.2% increase in December. This provided relief, lifting Bitcoin back above $106,000. Analysts attributed the recovery to cautious optimism surrounding the incoming pro-crypto Trump administration, which is expected to introduce favorable policies, reduce regulatory uncertainty, and even explore establishing a Bitcoin reserve.

The weekend added a new twist as President-elect Donald Trump’s Solana-based meme coin, $TRUMP, rallied on Friday, while his wife’s coin, $MELANIA, skyrocketed with returns exceeding 18,000% in a single day. The excitement pushed Solana’s native SOL token to a new all-time high of $293.31, marking a 28% gain over the week.

Overall, Bitcoin's dominance increased slightly to 56.3% this week, while total trading volume surged to nearly $400 billion on both Monday and Sunday. The total market capitalization stood at $3.57 trillion, down 6.9% for the week, as Bitcoin dipped below the $100,000 mark once again.

Top 3 News

Trump’s $TRUMP Coin Surges to $9B Market Cap in 1 Day

President-elect Donald Trump’s meme coin, $TRUMP, launched Friday, hit a $9 billion market cap, peaking at $15 billion. Most tokens are controlled by Trump Organization affiliates and are marketed as non-investment and non-political. This venture aligns with Trump’s broader push to make the U.S. a global crypto leader.

Tether Relocates to El Salvador

Tether relocates to El Salvador, securing a Digital Asset Service Provider (DASP) license to enhance Bitcoin adoption and innovation in emerging markets. By relocating its headquarters to El Salvador, Tether aligns with the country’s forward-thinking regulatory environment and growing digital asset ecosystem.

Coinbase Launches Bitcoin-Backed Loans

Coinbase has launched Bitcoin-backed loans, allowing users to borrow up to $100,000 in USDC without selling their Bitcoin. Powered by the Morpho protocol on Base, the loans offer competitive interest rates, flexible repayment terms, and enable users to access USDC for spending or conversion without triggering taxable events.

What Else Happened?

A new wave of crypto ETFs, including SOL and XRP, is set to launch under the pro-crypto Trump administration.

Trump’s administration plans executive orders on its first day to tackle de-banking and revise crypto accounting policies.

Pension funds in the U.S., UK, and Australia are cautiously entering crypto, with Wisconsin’s fund holding $155 million in Bitcoin ETFs.

Boerse Stuttgart Digital became the first German crypto exchange to receive an EU-wide MiCAR crypto license.

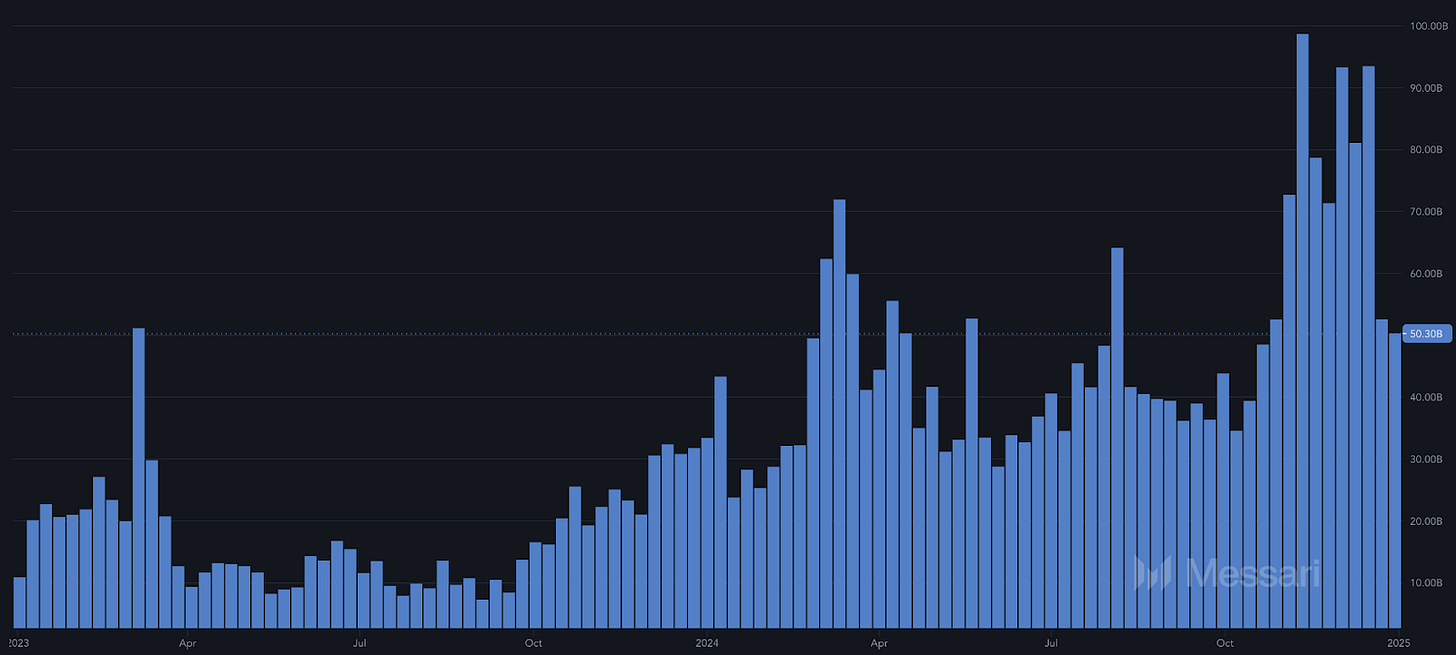

Circle’s annual report highlights $1 trillion in monthly USDC transactions and stablecoin adoption for cross-border payments and B2B use cases. → More insights in “This Week’s Focus”!

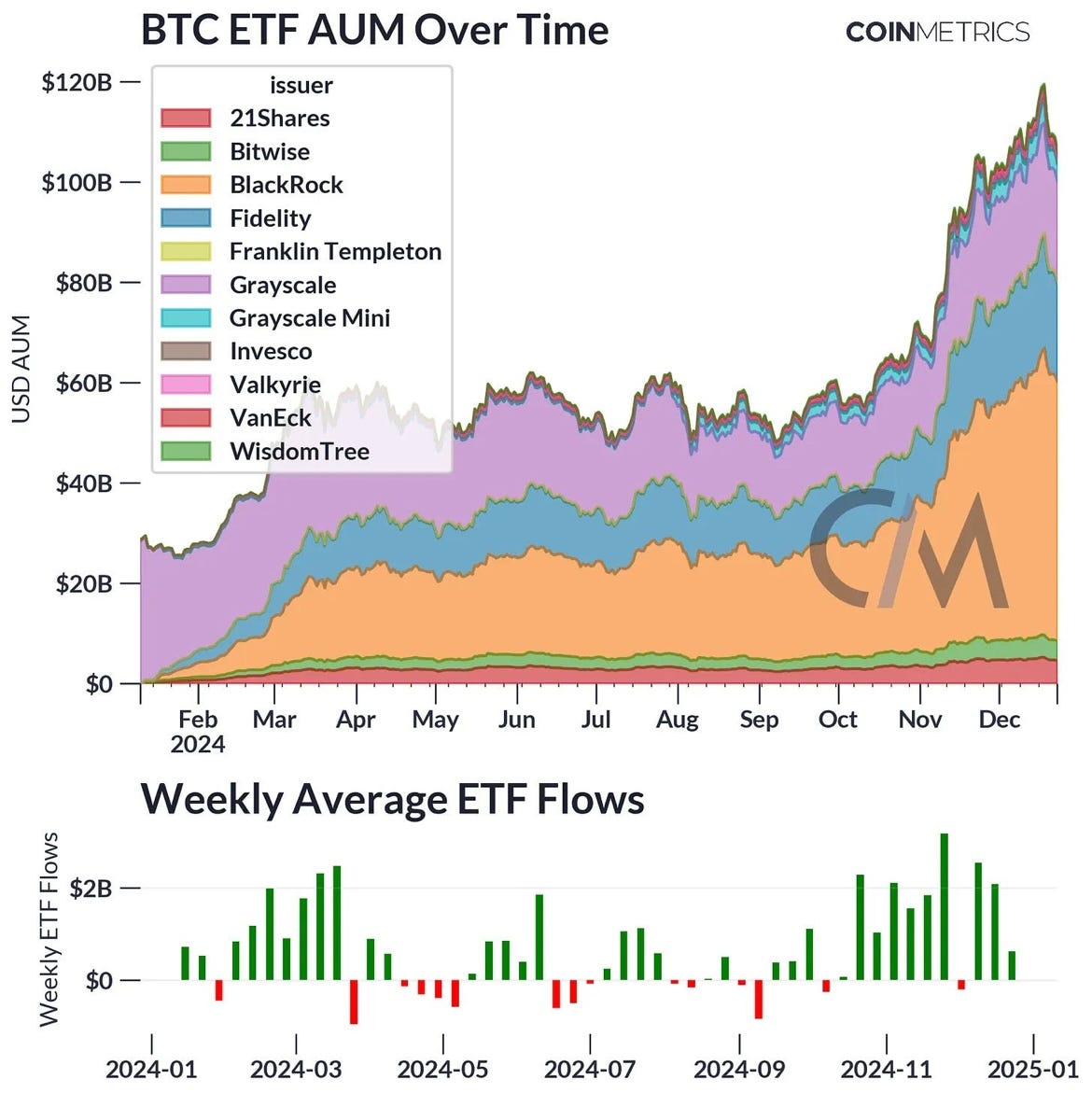

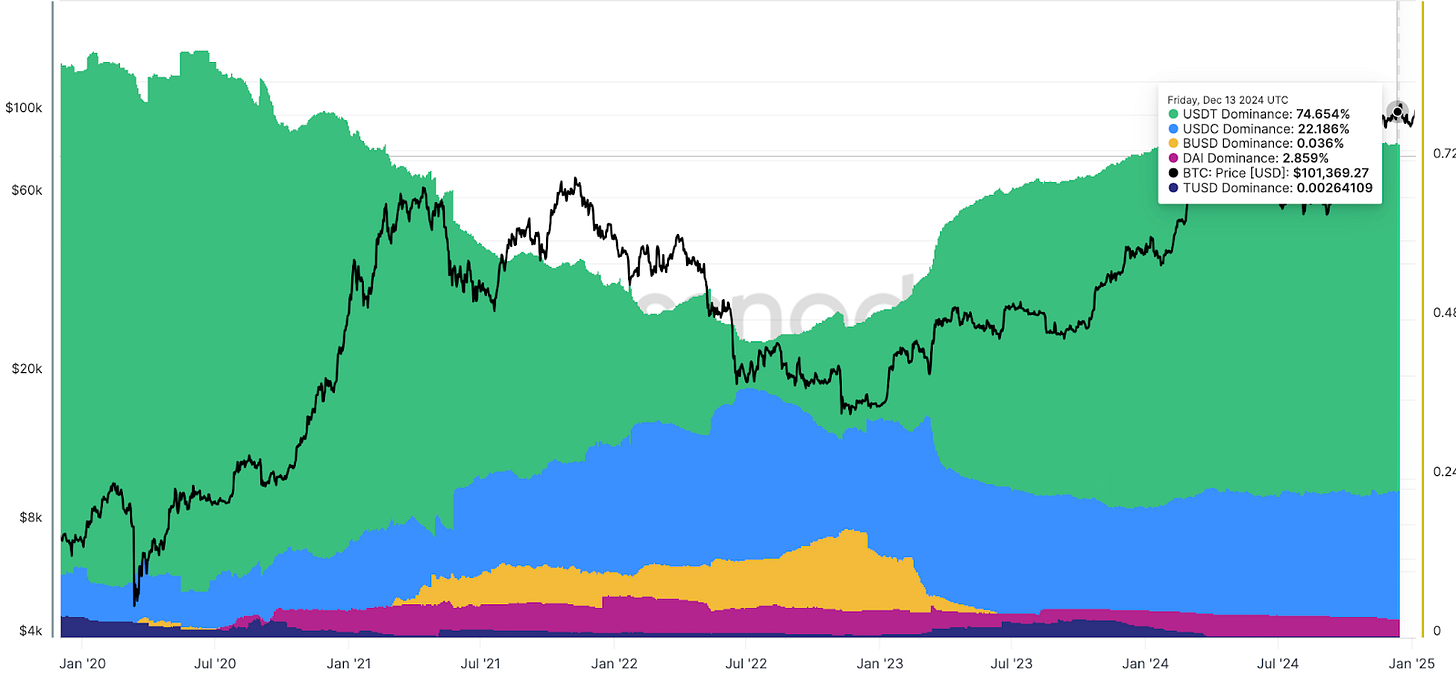

Chart of The Week

This Week’s Focus

USDC's Role in Global Finance: Insights From Circle’s Stablecoin Report

Circle’s annual “State of the USDC Economy” report highlights a transformative year for the stablecoin ecosystem. USDC circulation grew by 78% YoY, reaching $20 trillion in cumulative transaction volume in 2024. In addition, Circle has become the first stablecoin issuer to align with the EU’s MiCa Regulation and Canada’s listing rules, reinforcing its position as a leader in regulatory transparency.

Why Is This Relevant?

The report emphasizes USDC’s role in streamlining cross-border payments, fueling real-world economic inclusion, and powering blockchain ecosystems:

USDC's adherence to MiCAR and similar frameworks demonstrates a strong compliance standard, making it a trusted choice for broader adoption in finance and payments.

Innovations like the Cross-Chain Transfer Protocol (CCTP) improve flexibility across blockchain networks, showcasing how digital assets can streamline processes like FX settlements.

Partnerships with platforms like Nubank and Chipper Cash reveal the potential of digital currencies like USDC to provide scalable solutions for underserved regions.

Blockchain technology underpinning USDC offers a cost-efficient alternative to traditional payment infrastructure, as evidenced by collaborations with Mastercard and MoneyGram.

While Tether leads in stablecoin market share, USDC’s emphasis on regulatory compliance and its growing presence in Europe illustrate its strategic positioning for future growth.

Key Takeaways

Integration Potential: USDC can streamline cross-border payments, currency exchange settlements, and corporate Treasury operations.

Regulatory Blueprint: Circle’s compliance-first approach builds trust and mitigates risks.

Growing Demand: EURC (i.e., euro-denominated stablecoin by Circle) and other stablecoins are poised for increased adoption.