Digital Asset Weekly #1: Jan 13, 2025

Market Downturn Flags the Start of 2025, Elon Musk’s Crypto Plans, U.S. Bitcoin Sell-off Rumors, and More!

The past week saw the digital asset market continue its early 2025 decline, with headlines dominated by Elon Musk’s crypto payment plans, MicroStrategy’s latest Bitcoin purchase, and the U.S. government’s denial of Bitcoin selloff rumors.

In this issue, I cover:

Actionable insights on BlackRock’s Bitcoin portfolio strategy.

ECB’s research findings on Bitcoin adoption across economies.

Top news, including Elon Musk’s crypto payment plans and Vitalik Buterin’s $1M charity donation.

This week’s digital asset market snapshot.

In my year-end special edition, I outlined trends to watch in 2025. If you missed it, you can read my 2025 outlook for the digital asset industry here:

Enjoy reading!

Best,

Benjamin

Digital Asset Market Update: Kick Off 2025

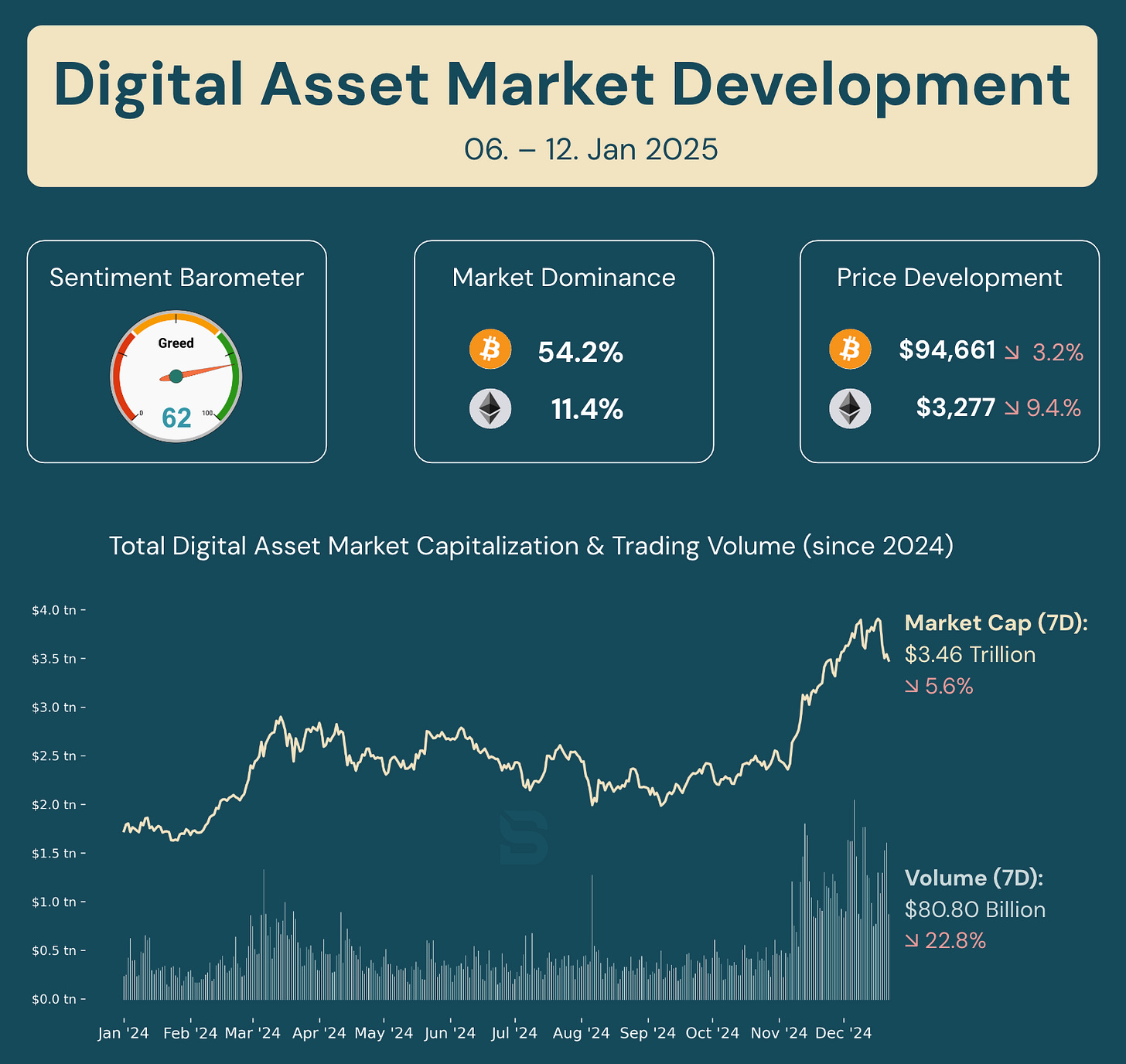

The digital asset market extended its decline in early 2025 following record highs at the end of last year. Between January 6 and 12, total market capitalization fell by 5.6% to $3.46 trillion, while trading volume plummeted 22.8% to $80.8 billion. Bitcoin dropped 3.2% to $94,661, showing relative resilience compared to Ethereum’s steeper 9.4% decline to $3,277. Bitcoin’s dominance remained steady at 54.2%, underscoring its stability amid the market downturn. Market sentiment dipped to 62, signaling cautious optimism despite a weak start to the year.

Sources: Alternative.me, CoinGecko, and Defillama

Top News

Elon Musk's Plans For A Crypto Payment Platform Launch

Elon Musk's X platform is reportedly preparing to launch "X Money," a payment system potentially supporting bitcoin and other cryptocurrencies. The move aligns with Musk's vision of transforming X into an "everything app," despite lacking regulatory approval in all 50 U.S. states. Speculation around cryptocurrency integration has intensified following recent updates from X executives.

→ Read more here.

U.S. Government Denies Rumors of Bitcoin Asset Sale

The U.S. government has denied rumors of plans to sell its $6.44 billion Bitcoin holdings seized from cases like Silk Road. Despite claims of a Department of Justice-sanctioned liquidation of 69,370 Bitcoin, blockchain intelligence firm Arkham confirmed the assets remain under government control.

→ Read more here.

MicroStrategy Expands Bitcoin Holdings with $101M Purchase

MicroStrategy has acquired $101 million worth of Bitcoin, increasing its holdings to approximately $44.3 billion. This purchase follows the announcement of a perpetual preferred stock offering aimed at raising additional capital for further Bitcoin investments. The company continues to pursue an aggressive Bitcoin acquisition strategy despite market volatility and shareholder concerns over potential stock dilution.

→ Read more here.

Bitcoin Miners Stockpile Amid Rising Costs and Competition

U.S. Bitcoin miners, including Mara Holdings and Riot Platforms, are accumulating Bitcoin reserves to weather tightening margins caused by high energy costs and increased competition. Miners raised over $3.7 billion since November to fund purchases, leveraging the cryptocurrency's recent surge past $100,000. Despite rising hash rates and profitability challenges, miners are pivoting to AI and offshore operations for diversification and growth.

→ Read more here.

Vitalik Buterin Sells Meme Coins for $1M Charity Fund

Ethereum co-founder Vitalik Buterin sold 28 meme coins, including DOGE and NEIRO, for $984,000 USDC to fund his biotech charity, Kanro. The sale, involving tokens donated by developers, caused sharp price swings in smaller markets, with some tokens dropping over 50% while others gained significantly.

→ Read more here.

More Digital Asset News:

Strive Files for Bitcoin Bond ETF Focused on MicroStrategy

→ Read more here.

Whale Alert: $1 Billion of XRP Transferred on Jan. 1, 2025

→ Read more here.

U.S. Regulator Warns of Oversight Gap on Digital Assets

→ Read more here.

Terraform Labs Founder Do Kwon Extradited to U.S.

→ Read more here.

Meme Coin Soars After Musk Changes Name to “Kekius Maximus” on X

→ Read more here.

This Week’s Focus

BlackRock’s Bitcoin Thesis: An Effective Strategy for Your Portfolio?

BlackRock, the world’s largest asset manager, recently published its report “Mega Forces: Sizing Bitcoin in Portfolios,” recommending a 2% Bitcoin allocation in traditional portfolios. This strategy balances Bitcoin’s high growth potential with manageable risk.

Bitcoin’s inclusion in institutional portfolio strategies reflects its growing acceptance as a legitimate financial asset. BlackRock’s recommendation signals a shift in how professionals should evaluate Bitcoin as part of strategic portfolio management, especially for balancing returns and risks in diversified portfolios.

How Effective Is This Strategy?

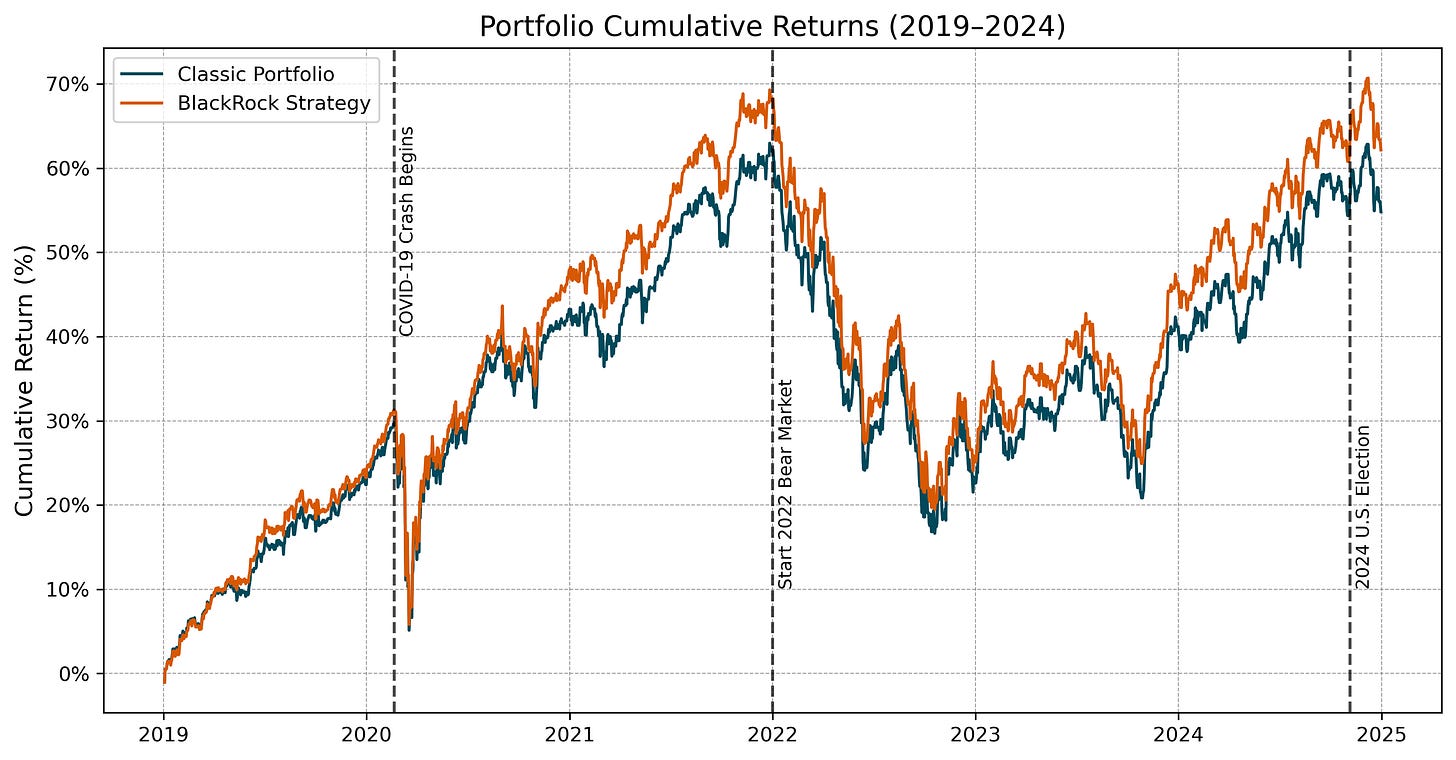

This strategy enhances returns and maintains a stable risk profile, outperforming the classic 60/40 portfolio over a six-year period, as shown in the chart below. The key findings are summarized as follows:

Enhanced returns: A 2% Bitcoin allocation boosted cumulative portfolio returns to 62.16%, compared to 54.82% for a classic 60/40 portfolio.

Improved risk-adjusted metrics: The Sharpe ratio for the Bitcoin-enhanced portfolio rose by 20%, reflecting a better return per unit of risk.

Manageable risk levels: Despite Bitcoin’s inherent volatility, it contributed just 3.75% to total portfolio risk, highlighting its modest impact on overall risk.

Key Takeaways for Investors

Performance boost: A 2% Bitcoin allocation improved cumulative returns significantly while maintaining a traditional equity-bond portfolio structure.

Balanced risk profile: The strategy shows that Bitcoin’s inclusion doesn’t overly increase portfolio risk, thanks to its low weighting.

Risk-adjusted growth: The improved Sharpe ratio demonstrates that Bitcoin can enhance returns relative to risk when integrated into a portfolio.

However, the following questions remain:

What are the trade-offs in terms of risk?

How does BlackRock’s strategy perform under market stress?

What impact would larger allocations have on portfolio performance and risk?

I answer these questions in my in-depth analysis. Read the full analysis here:

Research Highlight

Understanding Bitcoin's Role Across Economies

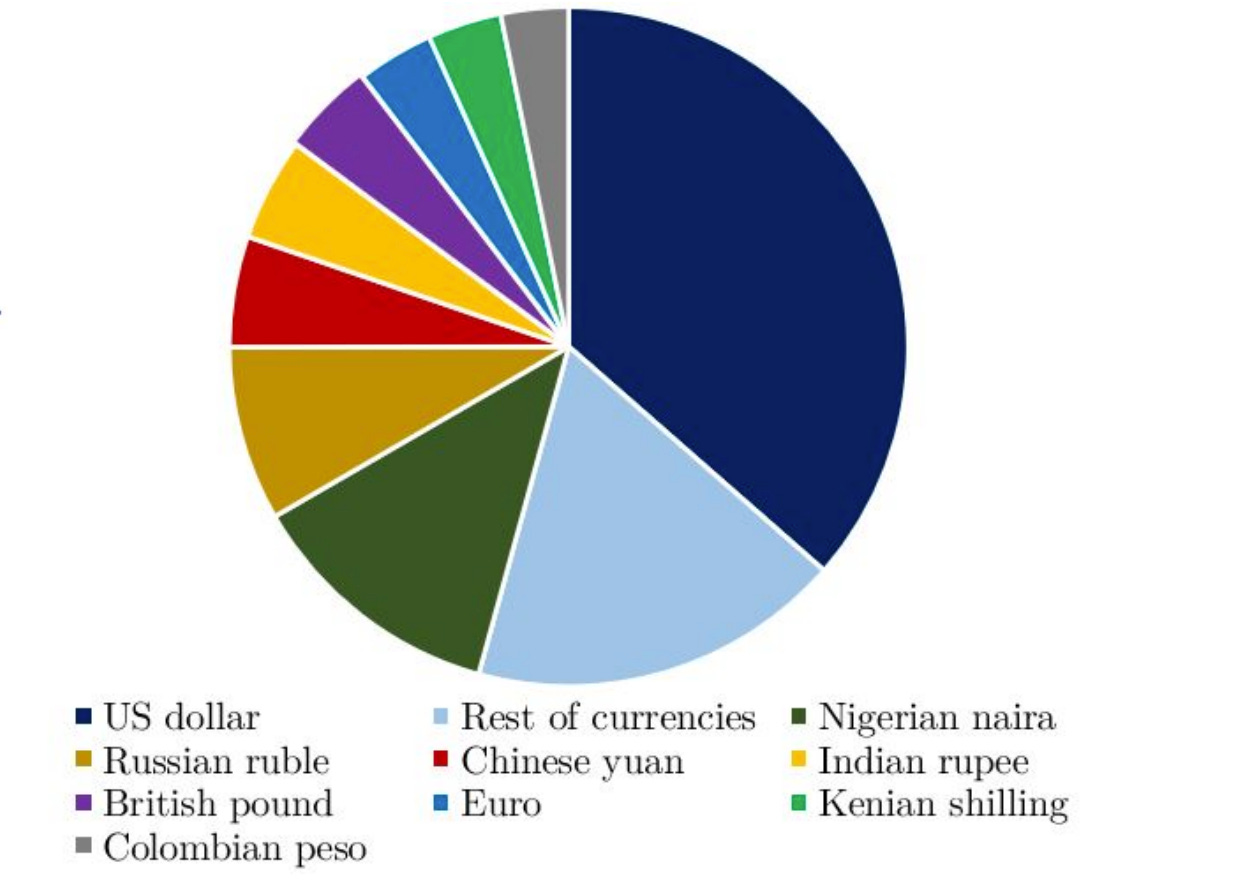

Bitcoin's adoption has evolved from a niche phenomenon to a global movement, with its impact felt across economies at varying levels of financial development. A recent study by the European Central Bank (ECB) explores the dynamics behind Bitcoin trading, shedding light on how global and local factors influence its usage. Particularly in emerging and developing economies (EMDEs), Bitcoin has transitioned beyond speculation to offer financial utility amidst economic instability.

What Was Analyzed?

The research investigates the factors driving Bitcoin trading against 44 fiat currencies on peer-to-peer (P2P) exchanges from 2018 to 2022. It focuses on both global influences (like market volatility) and local drivers (such as currency depreciation) while distinguishing between advanced economies (AEs) and EMDEs.

Key Findings

Speculative Cycle: A global "crypto cycle" links Bitcoin trading volumes with speculative market momentum, making it a primary factor worldwide.

EMDEs' Usage Patterns: In EMDEs, Bitcoin serves as a hedge or medium of exchange during currency depreciation, especially post-COVID-19.

Institutional Factors: A lack of banking depth and digital payment alternatives increases Bitcoin’s appeal in EMDEs, particularly among younger populations.

Financial Risks: The study highlights financial stability risks in EMDEs with underdeveloped financial systems, where "cryptoization" could undermine local monetary systems.

Why This Is Important

This study underscores the dual role of Bitcoin as a speculative asset and a transactional tool, emphasizing its broader adoption in financially underserved regions. By identifying key drivers of Bitcoin trading, the findings offer valuable insights into its impact on financial stability and market dynamics globally.

→ Explore the full research paper here.