Digital Asset Weekly #3: Jan 27, 2025

Crypto Decrees Signed, U.S. State Bitcoin Reserves, New Digital Asset ETFs, Ethereum vs. Solana, and More!

This week saw the first crypto-focused decrees signed by the new U.S. president, alongside sharp price drops for his meme coins. In this issue, I cover:

Legislation for state-level Bitcoin reserves.

New crypto ETFs in the pipeline.

Ethereum vs. Solana’s momentum.

This week’s digital asset market briefing.

Enjoy reading!

Best,

Benjamin

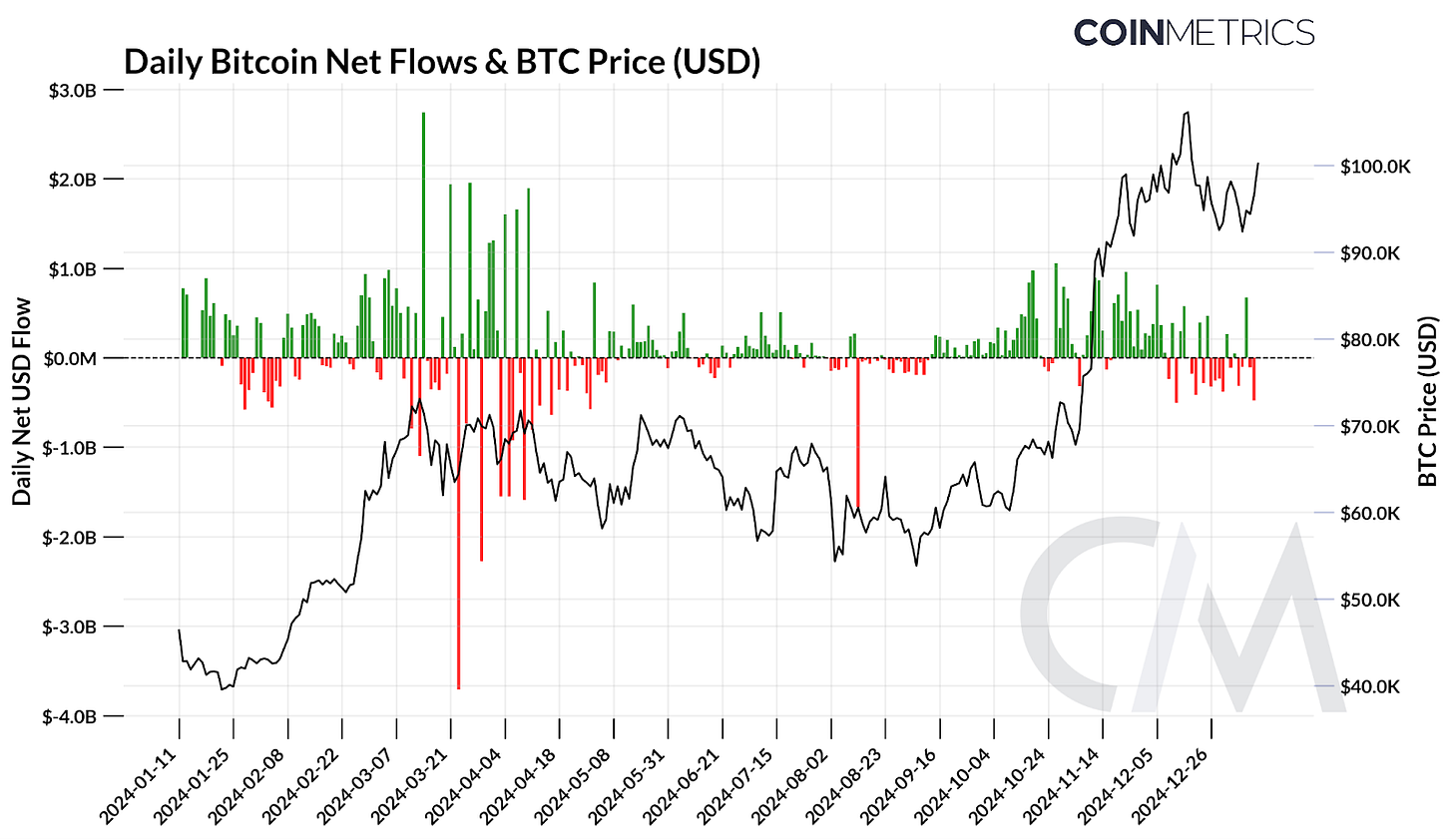

Digital Asset Market Briefing

This week marks the one-year anniversary of Bitcoin ETFs, which have significantly reshaped the digital asset industry. Over the past year, these ETFs attracted $115 billion in assets under management (AUM), with $32 billion in net inflows, and now hold about 5.7% of Bitcoin’s supply.

BlackRock’s iShares Bitcoin ETF leads with 540,000 BTC, while Grayscale’s holdings have declined as investors shift to lower-cost ETFs.

If you want to learn more about BlackRock's perspective on Bitcoin as an essential part of any portfolio, read the following article—now freely accessible!

Clearly, it can be stated that these funds have driven institutional adoption, solidifying Bitcoin’s status as a mainstream financial asset.

Amid this milestone, the past week brought relative stability to the market. Anticipation ran high as Donald Trump was inaugurated as the 47th U.S. president, promising pro-crypto policies, reduced regulatory uncertainty, and the exploration of a strategic Bitcoin reserve.

On his first days, Trump signed an executive order to strengthen American leadership in digital financial technology. Despite these developments, market sentiment stayed steady at 73, reflecting flat demand as the industry waits to see concrete policy actions.

Meanwhile, excitement over Trump’s meme coin, $TRUMP, and Melania Trump’s $MELANIA quickly evaporated just hours before the official presidential inauguration. Both assets saw dramatic declines, with $TRUMP falling nearly 60% from its peak of $75.83 and $MELANIA plummeting 81% from its high of $13.63.

Adding a humorous twist, U.S. issuers REXShares and Osprey Funds officially filed for a $TRUMP ETF.

Top 3 News

MARA Pushes for State-Level Bitcoin Reserves

The U.S.’s largest Bitcoin miner, MARA, is lobbying for state and federal Bitcoin reserves, with 11 states already considering legislation to establish such reserves, including Florida, Texas, and Wyoming.

Crypto ETFs Gain Momentum Beyond Bitcoin

SEC filings reveal 33 new crypto ETFs, with Solana leading (11 ETFs), followed by XRP (9) and Bitcoin/Ethereum (4 each), highlighting growing institutional interest in a broader range of digital assets.

SEC Launches Crypto Task Force

New SEC Acting Chair Mark Uyeda introduced the "SEC Crypto 2.0" approach by creating a dedicated Crypto Task Force, led by Commissioner Hester Peirce. This initiative aims to replace enforcement-driven strategies with clarity and collaboration, fostering innovation while addressing regulatory gaps.

What Else Happened?

Tokenized bonds may reach $300 billion by 2030, driven by cost savings and fractional ownership.

Germany’s KfW issued €9 billion in digital bonds, boosting Clearstream’s platform to €17.5 billion.

Singapore’s digital bond grant covers 30% of costs, competing with Hong Kong’s 50% program.

OKX gains MiCA pre-authorization, enabling regulated crypto trading across Europe with 240+ tokens.

Circle acquires Hashnote to expand USDC adoption and strengthen its role in tokenized markets.

Telegram partners with TON blockchain to power mini-apps and tokenize digital assets like NFTs.

If you found this newsletter valuable, please share it with your network and friends to help expand its reach!

Chart of The Week

This Week’s Focus

ETH vs. BTC: Shifting Dynamics in the Blockchain Ecosystem

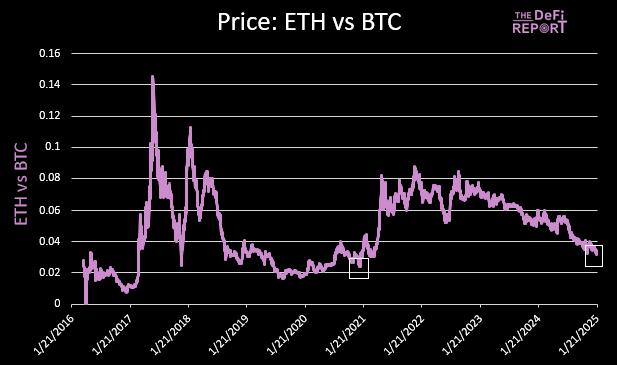

Bitcoin's dominance in the digital asset market has surged to 55%, pushing Ethereum to historical lows against Bitcoin. This mirrors the 2021 cycle, when Bitcoin dominance peaked at 63%, only for Ethereum to rally 5x in the subsequent months. While this historical precedent suggests potential for an Ethereum rebound, new market dynamics present additional challenges for ETH investors and enthusiasts.

Increasing Competition in the Market

Ethereum now faces headwinds from shifting community sentiment and rising competition from Solana (SOL). Solana has established itself as a dominant force, with notable growth in developer interest, token launches, and market dynamics. According to the latest developer report, Solana became the leading ecosystem for new developers in 2024, achieving an impressive 83% year-over-year growth.

Why This Matters

Solana’s rapid adoption and ability to attract talent and projects underscore its rising prominence. While Ethereum retains robust fundamentals and network effects, cracks in its community cohesion and possible fund rotations into Solana could significantly impact its market position.

Key Takeaways

ETH/BTC lows echo past cycles, suggesting a rally is possible but facing new challenges.

Solana’s growth in fundamentals and developer activity is reshaping market dynamics.

A potential rotation of capital from Ethereum to Solana could drive a "flippening" in valuations.

Source: The DeFi Report