Digital Asset Weekly #4: Feb 3, 2025

DeepSeek's Market Disruption, Tether's $13 Billion Profit, Bitcoin's Reserve Momentum, and More!

This week, AI-driven market disruptions and new U.S. tariffs fueled crypto volatility, while global Bitcoin reserve debates gained momentum. In this issue, I cover:

DeepSeek triggers market volatility.

ECB rejects Bitcoin reserve.

Tether’s record year.

This week's market commentary on digital assets.

Enjoy reading!

Best,

Benjamin

Digital Asset Market Briefing

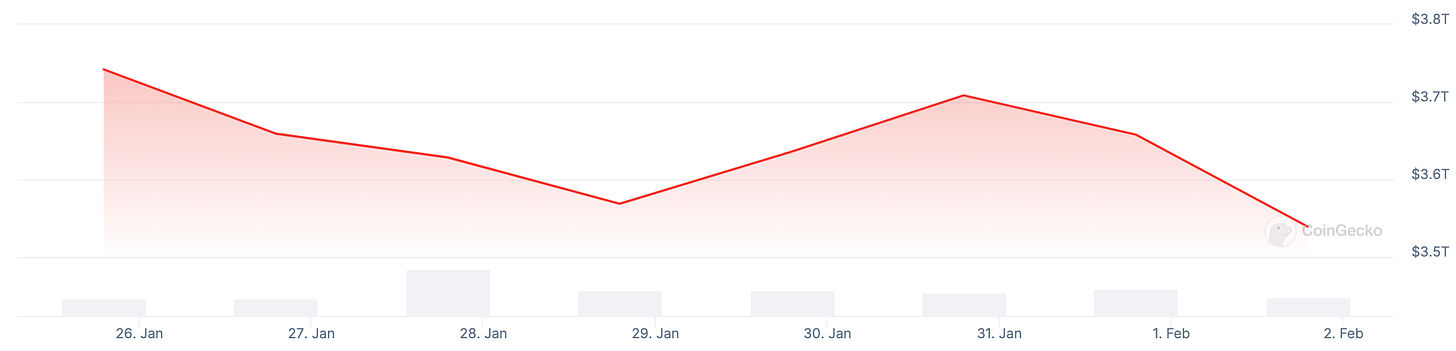

The week opened with a sharp crypto market sell-off, dragging Bitcoin below $98,000 and triggering nearly $900 million in liquidations. The decline was attributed to the sudden rise of DeepSeek, a Chinese AI app that quickly topped Apple’s App Store, raising concerns over AI-driven market disruptions and speculative capital shifts.

Despite the downturn, MicroStrategy continued its aggressive Bitcoin accumulation, purchasing 10,107 BTC for $1.1 billion at an average price of $105,596 per BTC. The firm’s total holdings now stand at 471,107 BTC, valued at approximately $49.4 billion. To support further acquisitions, MicroStrategy issued a $563.4 million perpetual preferred stock offering and initiated a $1.05 billion debt buyback.

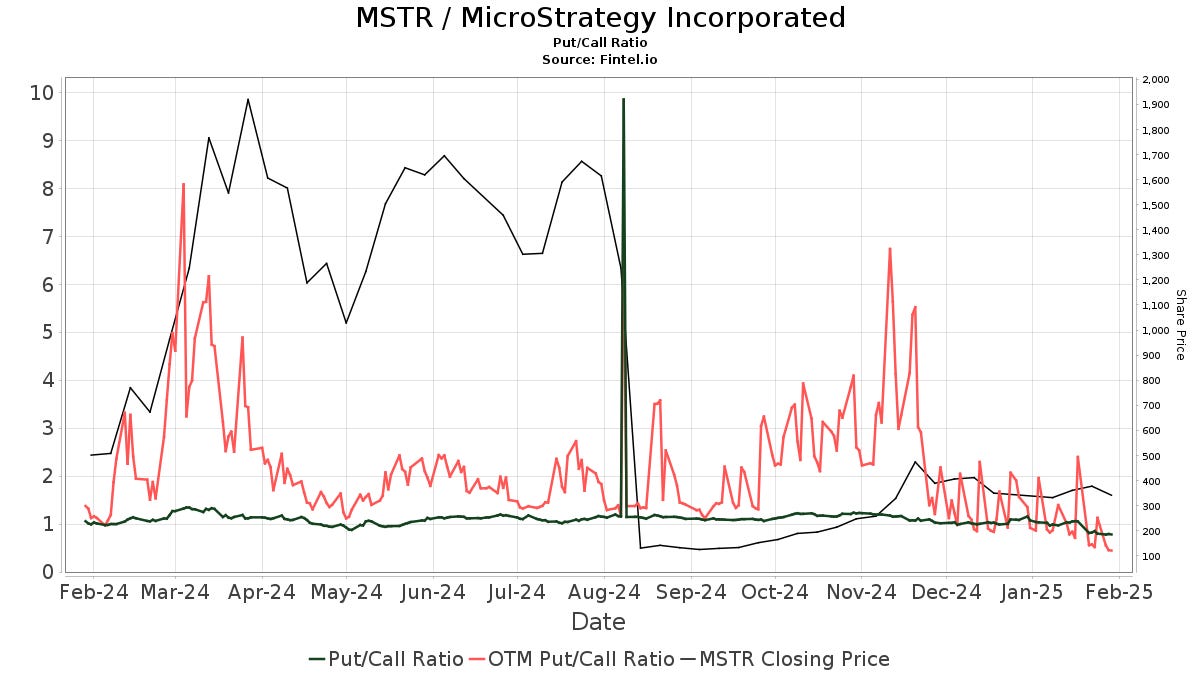

MicroStrategy’s Option Activity Reflects Bullish Sentiment

MicroStrategy’s open interest climbed 2.8% to 2.3 million contracts—more than double its 52-week average—while the put/call ratio dropped to 0.76. The increased weighting toward call options signals growing investor confidence, most likely fueled by MicroStrategy’s expanding Bitcoin reserve accumulation.

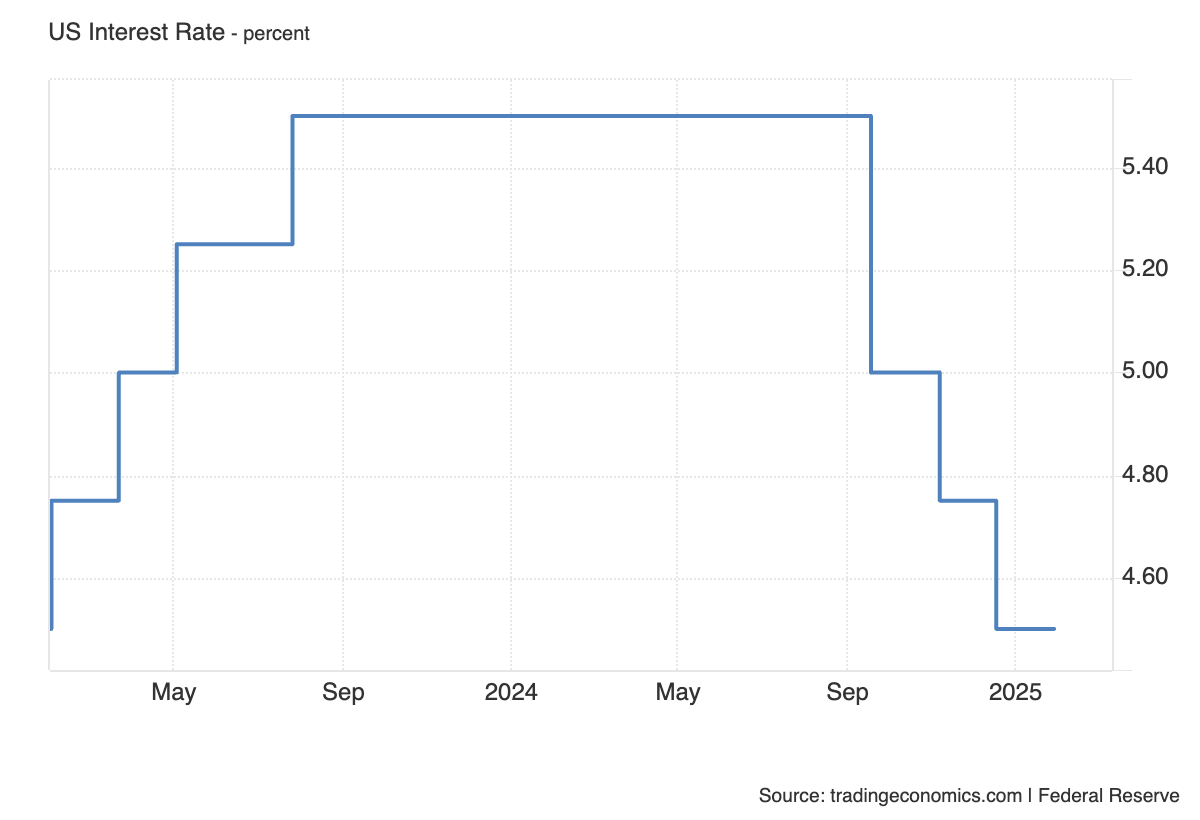

Midweek, the Federal Reserve held interest rates at 4.25%-4.5%, pausing after three 2024 rate cuts (see chart below).

Furthermore, Chair Powell reiterated that banks can offer crypto services in the U.S., though regulatory uncertainty persists. The crypto market briefly rebounded by $140 million but ended the week at $3.49 trillion, down by 7.16%.

This is mainly due to U.S. President Trump imposing 25% tariffs on nearly all Mexican and Canadian imports and 10% on Chinese goods. The weekend's risk-off sentiment hit crypto markets hard, with Bitcoin dropping to $99,100 and altcoins suffering steeper losses.

Among top assets, Solana (SOL) saw the steepest losses, falling 16.6%, reflecting a broader risk-off sentiment across digital assets.

Market sentiment dropped to 60, reinforcing investor caution amid ongoing macroeconomic and regulatory uncertainties.

Top 3 News

Czech Central Bank Eyes 5% Bitcoin Reserve

The Czech National Bank is considering allocating up to 5% (approx. €7 billion) of its reserves to Bitcoin, marking a potential first for Western central banks. However, European Central Bank President Christine Lagarde quickly dismissed the idea of a European Bitcoin reserve.

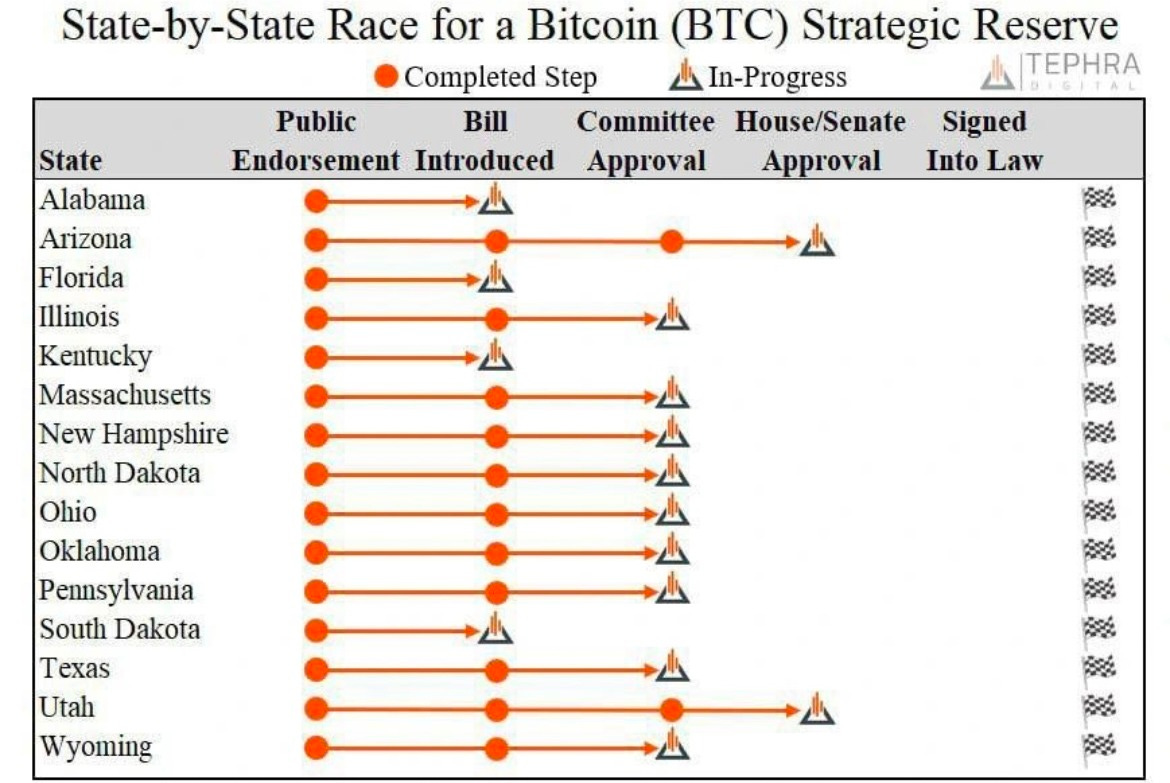

U.S. States Push for Bitcoin Reserves

Arizona and Utah await House approval for state-level Bitcoin reserves, while 13 other U.S. states explore similar initiatives. If passed, this could accelerate Bitcoin adoption at the state level and beyond.

Tether Posts $13 Billion Profit

Tether reported a record $13 billion profit in 2024, driven by rising Bitcoin and gold prices. The firm increased its Bitcoin holdings to 84,000 BTC, worth $7.8 billion at year-end.

What Else Happened?

The SEC fast-tracked Bitwise’s new crypto ETF, comprising 83% Bitcoin and 17% Ethereum.

Kraken to delist USDT and other stablecoins for European users by March 31 due to new MiCA regulations.

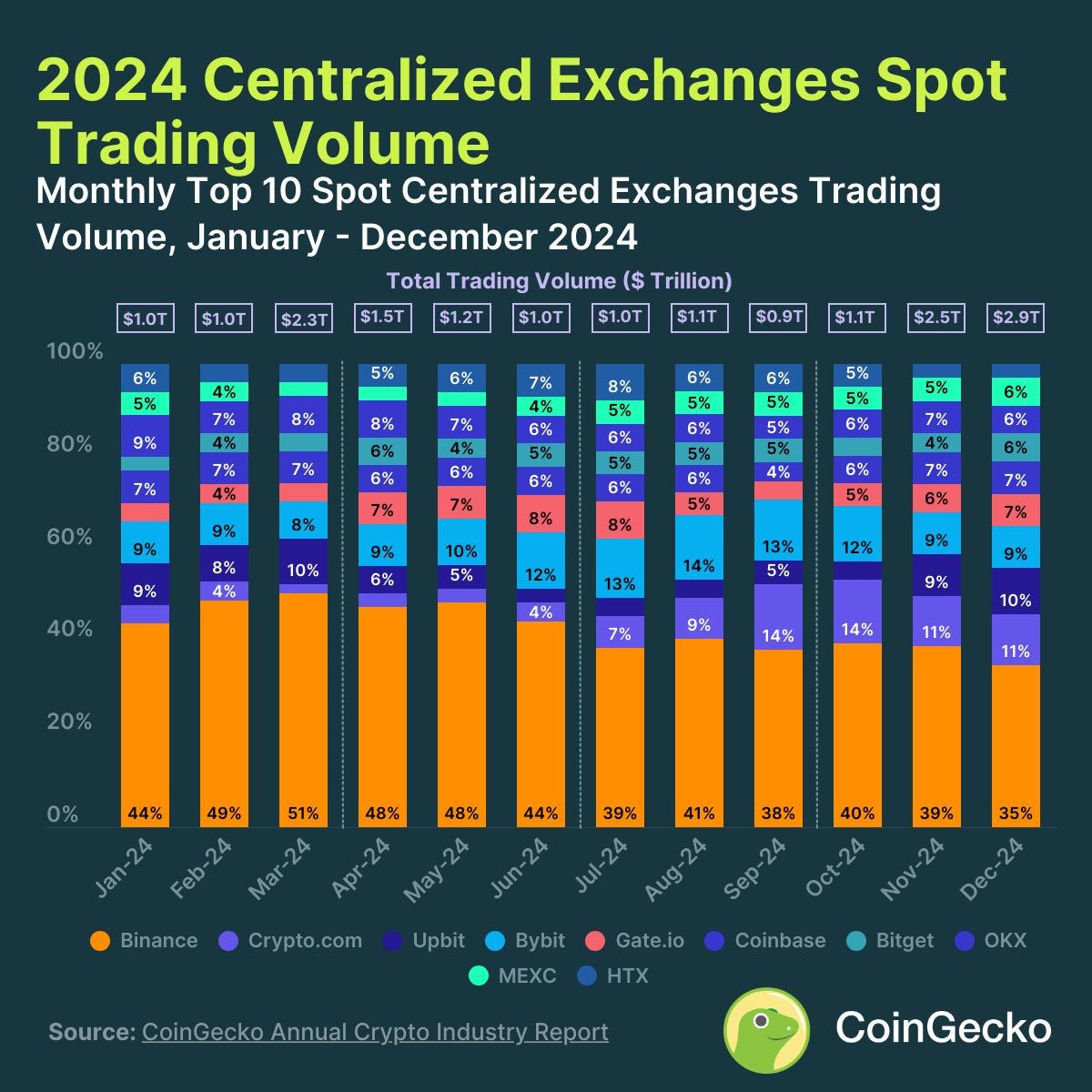

Binance faces increased scrutiny in France over alleged money laundering violations.

Thailand to launch Baht stablecoin backed by government bonds, targeting an October launch.

The South African Reserve Bank rejects Bitcoin reserves, questioning their place alongside traditional assets.

Poland surpasses El Salvador in Bitcoin ATMs with now 219 active crypto ATMs, ranking fifth globally after the U.S., Canada, Australia, and Spain.

Sam Bankman-Fried’s parents are lobbying for a pardon, citing Trump’s previous clemency for Silk Road’s Ross Ulbricht.

If you find these updates valuable, please share them with your network and friends to help expand their reach!

Chart of The Week

This Week’s Focus

How Much Bitcoin Belongs in Your Portfolio?

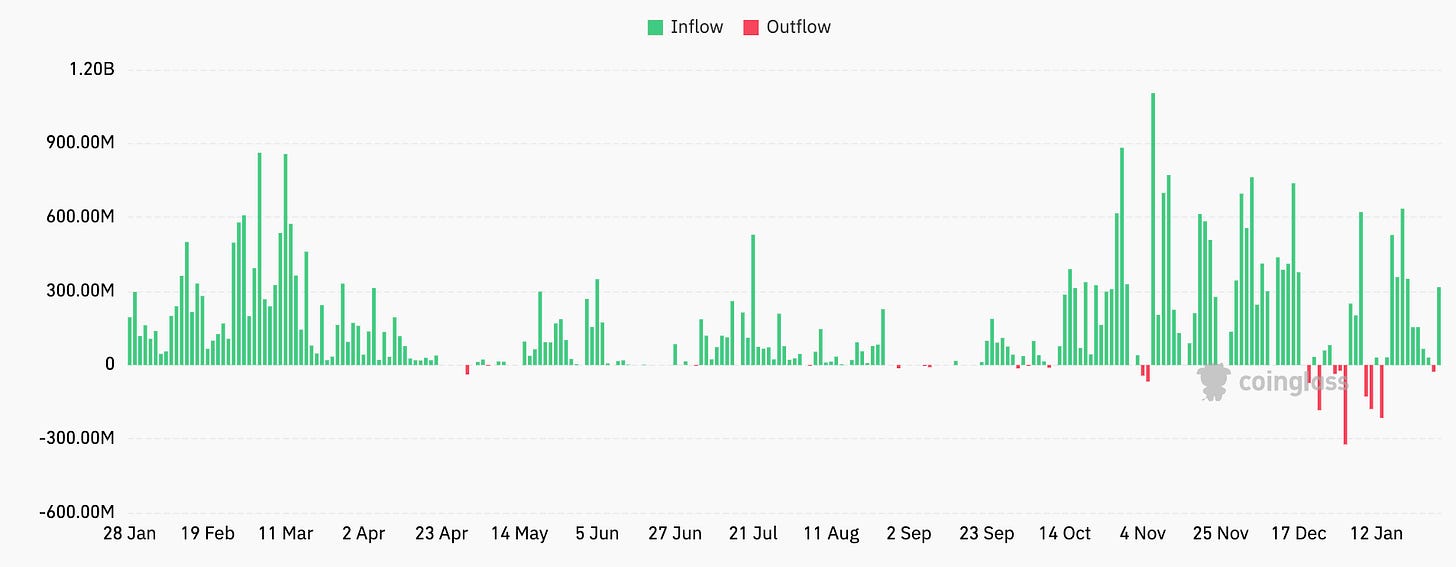

Last week, Bitcoin ETFs saw $1.76 billion in net inflows, led by BlackRock’s IBIT, which added $1.32 billion alone—bringing its total inflows to nearly $40 billion. Bitcoin ETFs now hold 5.92% of Bitcoin’s total supply, marking a historic shift in institutional adoption. BlackRock’s IBIT leads with ~540K BTC, representing 2.75% of circulating Bitcoin.

As institutional adoption accelerates, BlackRock maintains that Bitcoin enhances portfolio performance but recommends limiting allocations to 1–2% to manage risk.

Three Key Claims BlackRock Makes

Bitcoin is a long-term diversifier:

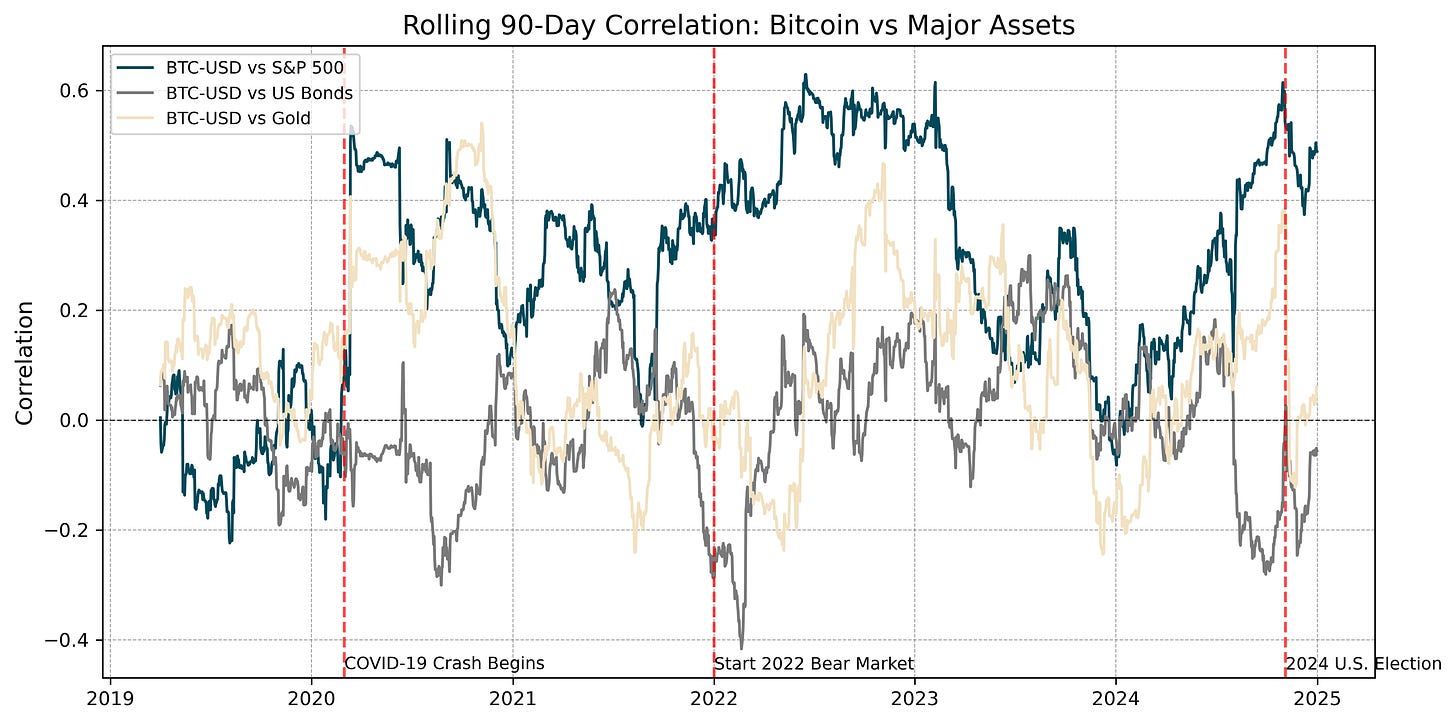

It has historically shown low correlation to traditional assets, but is it truly a hedge in all market conditions?

Bitcoin behaves like a high-risk tech stock:

Its volatility is often compared to mega-cap stocks like Apple and Microsoft, but does it follow the same market dynamics, or is it fundamentally different?

Allocating more than 2% increases risk too much:

BlackRock suggests capping allocations at 1–2%, but is this the optimal balance between return and risk?

Why This Matters

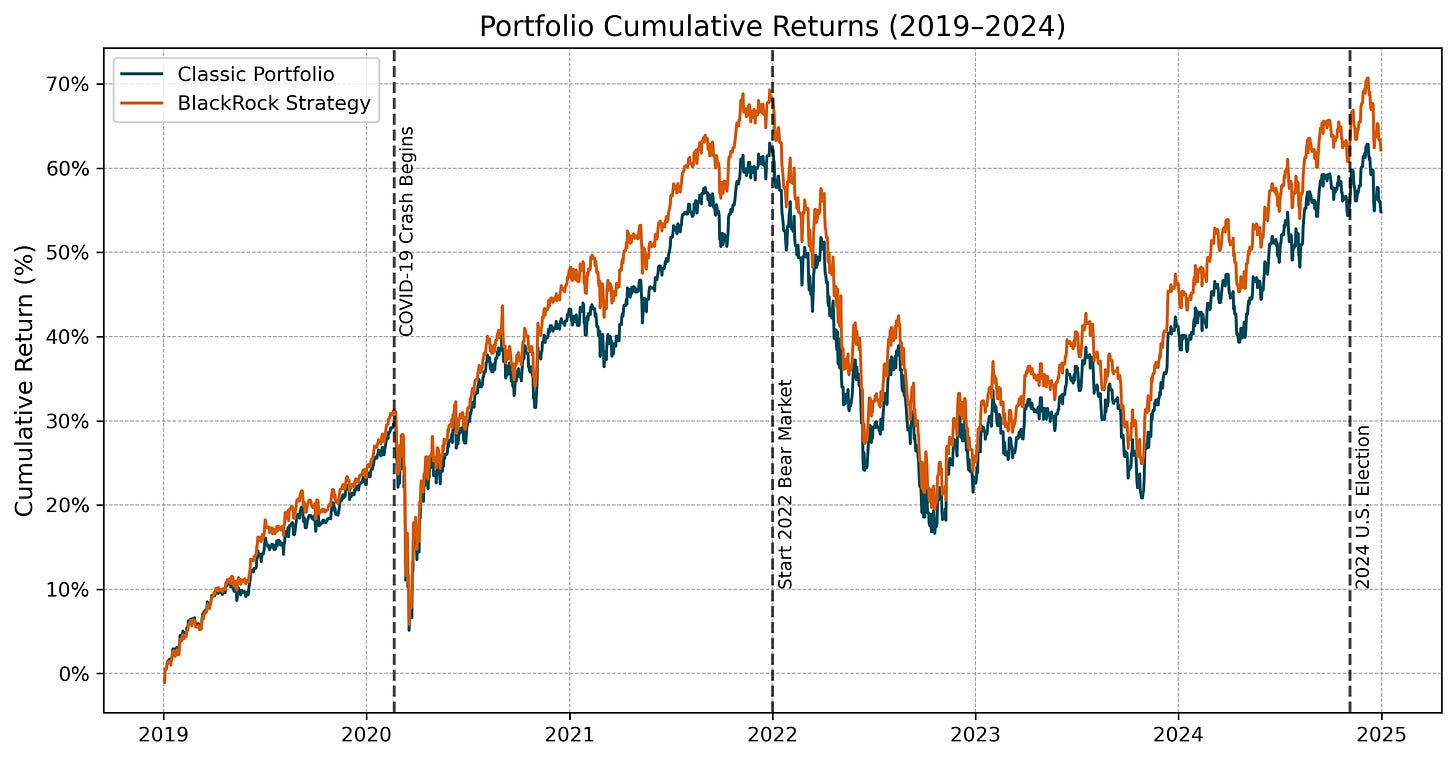

From 2019 to 2024, BlackRock’s strategy delivered a 10.94% cumulative return, outperforming the classic 60/40 portfolio’s 9.65%.

However, Bitcoin’s role in portfolios remains controversial. During market shocks, Bitcoin sometimes aligns with equities, but in short-term crises, it can decouple—offering unique diversification benefits, as shown in the chart below.

In general, a 2% allocation contributes just 3.75% to total portfolio risk, while a 20% allocation amplifies risk to over 61%!

Key Takeaways

1–2% balances risk and upside, fitting conservative strategies.

10–20% allocation enhances risk-adjusted returns but increases volatility and drawdowns.

Bitcoin’s risk profile shifts—active rebalancing is essential for long-term stability.

Want the full picture? Explore the complete analysis below!