Digital Asset Weekly #6: Feb 17, 2025

XRP Surges 14.1% on ETF News, Meme Coin Mania in Politics, and Newsletter Update!

This week, rising U.S. inflation data and a hawkish Fed outlook pressured crypto markets, while regulatory signals sparked optimism for XRP and Dogecoin ETFs. In this issue, I cover:

Argentine president’s token crash.

Michigan’s Bitcoin reserves approach.

Meme coin mania in politics.

This week's digital asset market briefing.

Coming Soon:

I’m excited to share that this newsletter is evolving to deliver more data-driven insights, with a sharper focus on institutional-grade analysis and market perspectives on digital assets.

To give you a glimpse of what's ahead, explore this recent in-depth analysis on institutional crypto:

As part of this direction, I’m developing an interactive Crypto Analytics Tool, designed to help investors analyze digital asset risks with institutional-grade rigor.

I’m currently seeking alpha testers for feedback. If you’re interested, feel free to reach out via Substack, LinkedIn, or simply fill out this Google form.

Stay tuned, and enjoy reading!

Best,

Benjamin

Digital Asset Market Briefing

The digital asset market remained under pressure, with total market capitalization hovering at $3.3 trillion, largely flat from the previous week. Bitcoin and ETH traded sideways, while Bitcoin’s dominance slipped from 58.6% to 57.4%. Notable gainers included XRP (+14.1%), which surged after the SEC acknowledged spot ETF filings from Grayscale and 21Shares. Also, Cardano (ADA) and Binance Coin (BNB) performed strongly, gaining 12.8% and 9.4%, respectively.

However, macroeconomic pressures weighed on the market. Exceeding expectations of U.S. inflation data saw the headline Consumer Price Index (CPI) rise from 2.9% in December, fueling concerns of prolonged monetary tightening, pushing Bitcoin below $95,000 before it rebounded to $96,000.

The 10-year U.S. Treasury yield spiked from 4.4% to 4.6%, reinforcing concerns that higher yields could make traditional assets more attractive than crypto assets. Fed Chair Jerome Powell, in his Senate testimony, reaffirmed the 2% inflation target and stated there was “no rush” to cut interest rates, signaling a continued hawkish stance.

Despite these headwinds, optimism emerged from the regulatory front. As mentioned above, the SEC’s acknowledgment of Grayscale’s XRP and Dogecoin ETF applications sparked market excitement, with Polymarket odds of approval rising to 81% for XRP and 75% for DOGE. Analysts, including Bloomberg’s James Seyffart, placed XRP’s approval chances at 65% and DOGE’s at 75%.

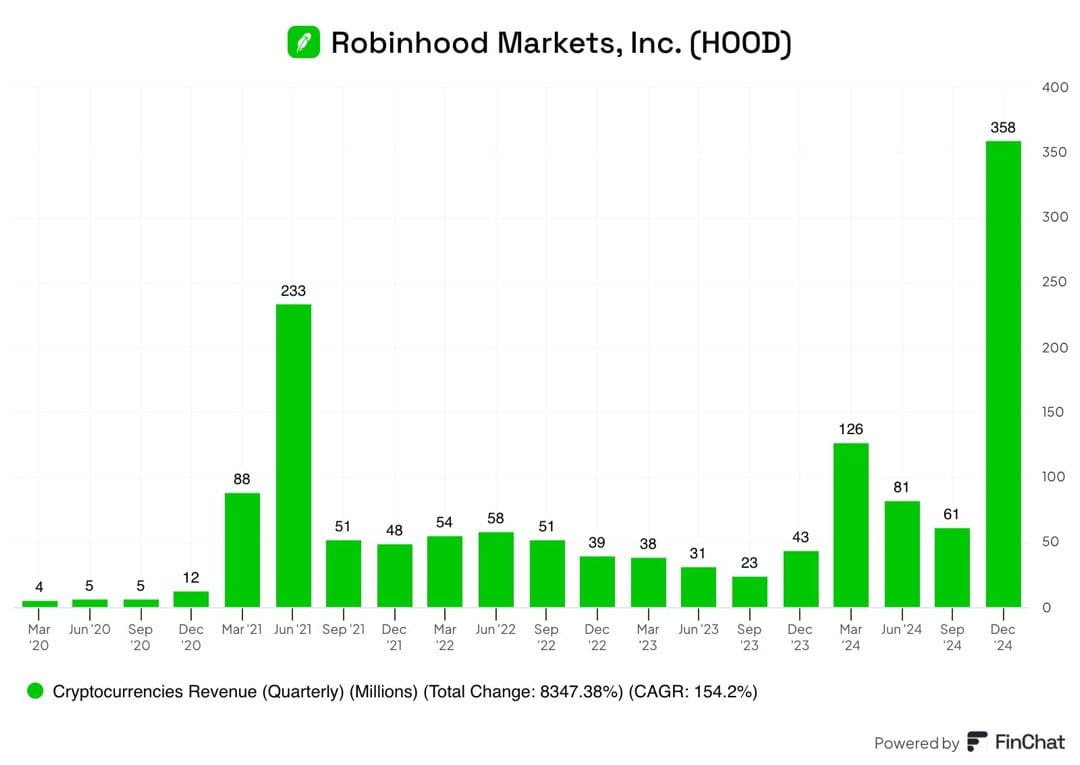

Meanwhile, retail interest surged, with Robinhood posting a 700% increase in crypto trading revenue in Q4 2024, signaling renewed retail engagement, while Coinbase’s earnings report revealed a net income of $1.29 billion in the same period.

Adding to market anticipation, the upcoming $16.5 billion repayment to FTX creditors on February 18, 2025, could inject fresh liquidity, potentially fueling a broader market rebound.

Top 3 News

Argentine President’s Libra Token Plunges 94% in Market Collapse

Argentine President Javier Milei faces impeachment calls after endorsing the $LIBRA token, which crashed over 94% in hours, wiping out $4 billion in value. On-chain data revealed insider wallets cashed out $107 million shortly after launch, sparking investigations into potential misconduct.

→ More on this topic in This Week’s Focus below.

Michigan Joins US State-Level Crypto Reserve Push

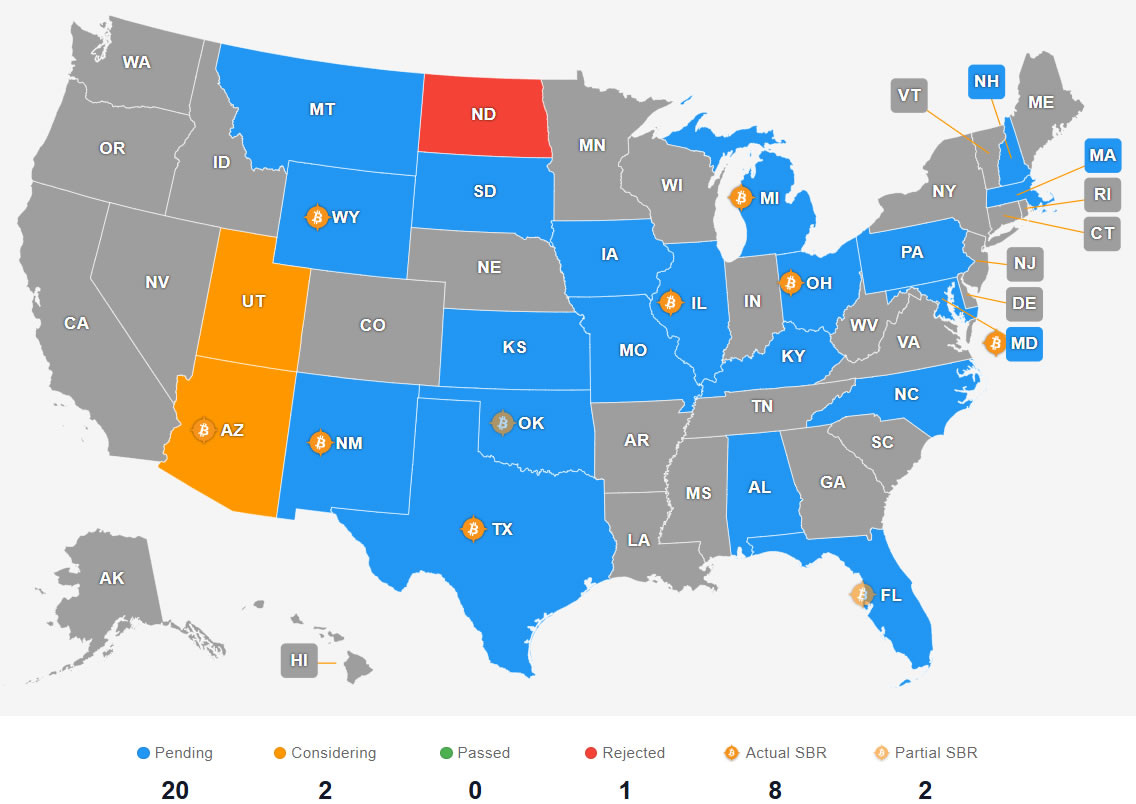

The state of Michigan proposed a Bitcoin reserve bill, becoming the 20th U.S. state to pursue crypto investment legislation. The bill allows up to 10% of state reserves in crypto assets and introduces a potential state-backed stablecoin, labeled as “MichCoin”.

Coinbase CEO Predicts 10% of Global GDP to Be On Blockchain by 2030

Coinbase CEO Brian Armstrong predicts up to 10% of global GDP could run on blockchains by 2030, highlighting crypto’s growing role in the global economy. He noted that the U.S. now has its "most pro-crypto Congress," paving the way for regulatory shifts.

What Else Happened?

US endowments enter crypto as universities raise a $5 million bitcoin fund.

Barclays reveals $131 million investment in BlackRock Bitcoin ETF.

Abu Dhabi’s sovereign fund buys $436 million worth of Bitcoin ETFs.

Indian authorities seize $190 million tied to the BitConnect Ponzi scheme.

South Korea announces a phased crypto access plan for corporates.

Nigeria launches the regulated cNGN stablecoin across multiple blockchains.

BIS head questions if wholesale CBDCs could reduce stablecoin demand.

Fed Governor Waller reaffirms support for stablecoins over CBDCs.

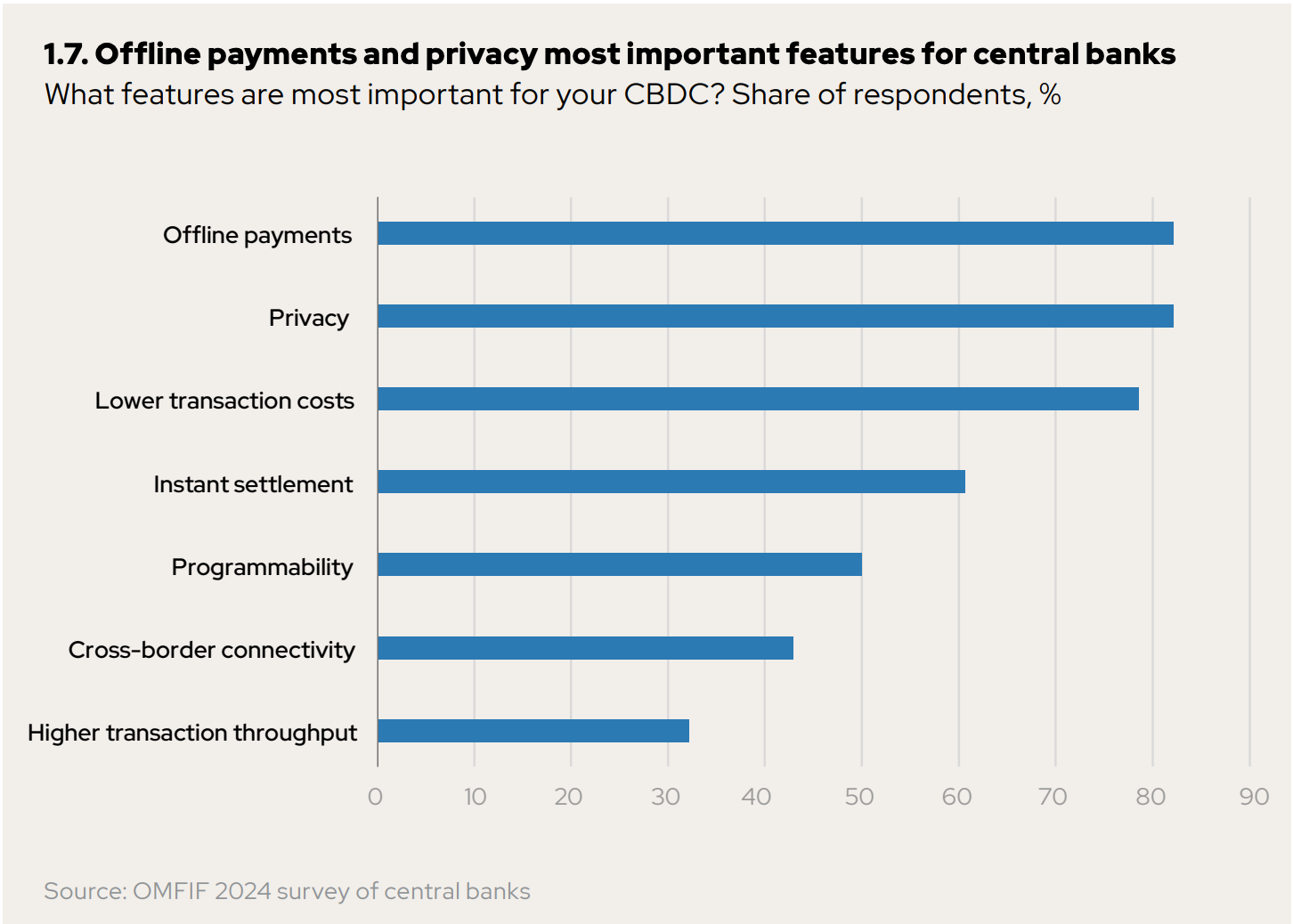

An OMFIF survey finds 72% of central banks plan to issue a CBDC within five years.

If you find these updates valuable, please share them with your network and friends to help grow the newsletter!

Chart of The Week

This Week’s Focus

Meme Coin Mania in Politics

Political figures and governments are embracing meme coins as a novel fusion of digital engagement and finance.

Recent launches from U.S. President Donald Trump ($TRUMP), First Lady Melania Trump ($MELANIA), Argentine President Javier Milei ($LIBRA), and Central African Republic (CAR) President Faustin-Archange Touadéra ($CAR) have ignited debate over their motives, impacts, and risks.

Motives and Momentum

These political memecoins blend financial speculation with public sentiment and branding, emerging from the broader trend of meme coins, popularized by early examples like Dogecoin (DOGE) and Pepe (PEPE). Trump’s $TRUMP coin, launched before his inauguration, raised billions, generating $100 million in fees for his family but leaving over 810,000 wallets with losses after a price crash.

According to Arthur Hayes, $TRUMP serves as a powerful political advertisement, offering a real-time gauge of popularity Meanwhile, $MELANIA, following her NFT ventures, highlights political branding in the crypto space. Milei’s $LIBRA token, launched to support Argentina’s economy, collapsed after insiders cashed out $107 million, sparking public outcry and impeachment calls.

In contrast, the Central African Republic’s coin aimed to fund local projects and promote national pride but suffered a 90% price drop shortly after launch.

Impact: The Good and the Bad

On the positive side: These meme coins redefine political engagement, transforming supporters into investors and creating alternative fundraising methods. They showcase crypto’s potential for financial inclusion and national fundraising.

However, the downsides are stark: pump-and-dump schemes, insider trading, and sharp price crashes have caused massive retail losses, eroding trust in the crypto ecosystem. Additionally, using speculative assets for political gain raises concerns about conflicts of interest and the exploitation of political supporters.

What’s Next?

The political meme coin trend will likely continue, driven by internet culture and the convergence of politics and finance.

However, the controversies surrounding $TRUMP and $LIBRA are prompting calls for regulatory oversight. Future projects may face stricter rules, with sustainability hinging on transparency, utility beyond speculation, and clearer investor protections.

Key Takeaways

Meme coins are emerging as tools for political engagement and fundraising.

Volatility, manipulation, and insider schemes have led to significant losses.

Growing scrutiny may drive clearer rules and stronger investor protections.

Sources: BBC (1), BBC (2), BeInCrypto, Cointelegraph, DexScreener, The Conversation, The Korea Times, and The New York Times