BlackRock’s Bitcoin Play: Beyond the 2% Allocation

Exploring Higher Bitcoin Allocations and Their Impact on Portfolio Performance

The Dynamics of Different Allocation Scenarios

Our previous analysis explored Bitcoin’s impact on portfolio performance and its behavior during market downturns, showing that a modest allocation improved risk-return dynamics. This leads us to the following question:

What are the implications of increasing Bitcoin’s allocation to 5%, 10%, or even 20%?

In this final part of our series, we assess BlackRock’s investment thesis by analyzing how larger Bitcoin allocations impact returns, risk, and portfolio composition. We conclude by determining to what extent BlackRock’s claims hold up—and what this means for optimal portfolio strategy.

Key Takeaways for Investors & Asset Managers

Higher Bitcoin Allocations Boost Returns but Add Risk

A 10–20% allocation improves returns and the Sharpe ratio but raises volatility and drawdowns—suitable for high-risk investors.1–2% Maintains Diversification

BlackRock’s recommended range balances upside potential with controlled risk, avoiding excessive concentration.Bitcoin’s Diversification Varies by Market Conditions

It decouples in short-term shocks but aligns with equities in prolonged downturns—risk management is key.Active Allocation & Rebalancing Are Essential

A dynamic strategy can optimize returns while managing Bitcoin’s growing impact on portfolio risk.

Missed the first two parts? Catch up here:

Bitcoin Allocation Scenario Analysis

Let’s now examine how varying Bitcoin allocations impact portfolio performance, risk, and diversification over the sample period (2019-2024). By comparing BlackRock’s strategy with scenarios of 5%, 10%, and 20% Bitcoin allocations, we assess the trade-offs between enhanced returns and increased risk.

Additionally, we explore Bitcoin’s growing contribution to portfolio risk and examine how its allocation impacts the Sharpe ratio. These insights will offer a broader perspective on Bitcoin's role in portfolio construction as allocation levels increase.

Does Increasing Bitcoin Allocation Enhance Portfolio Returns?

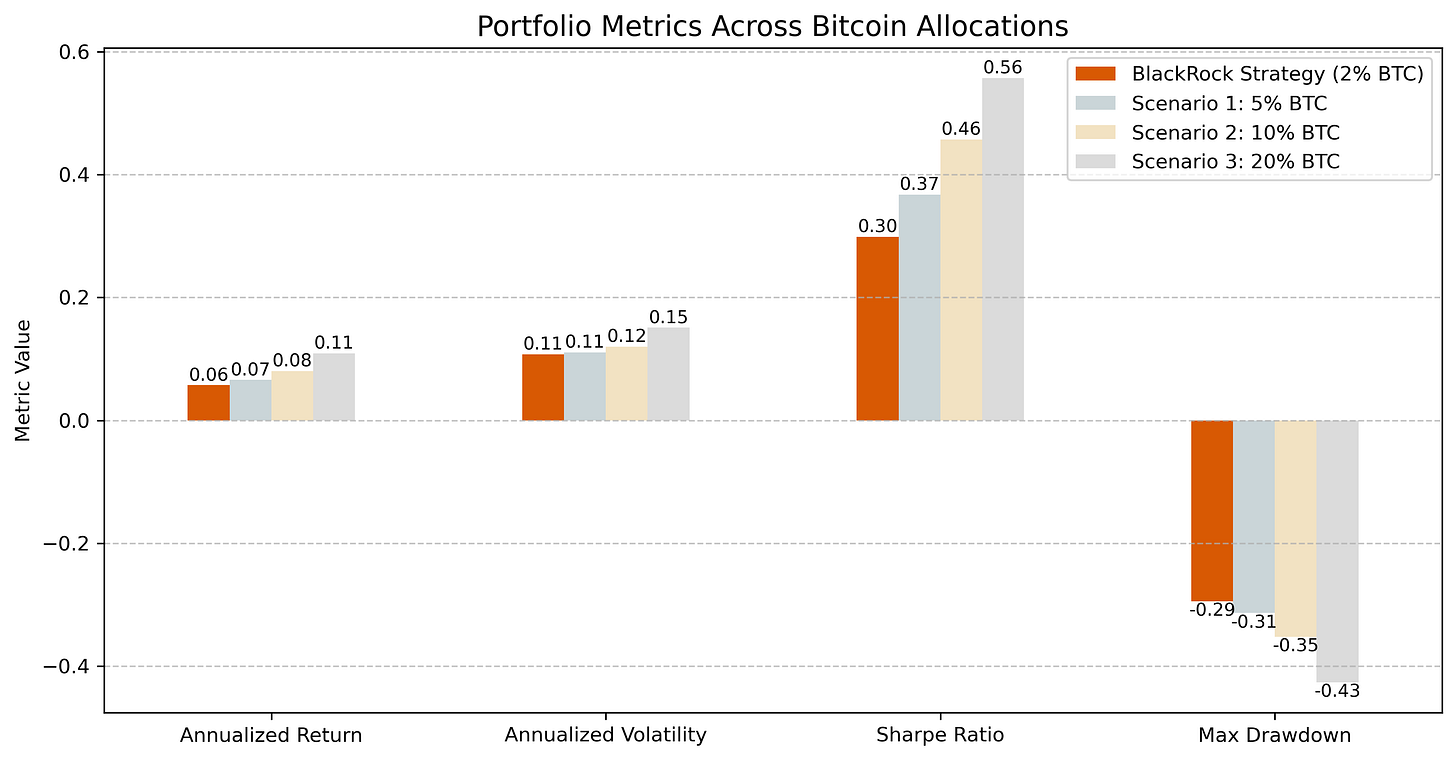

The performance metrics across various Bitcoin allocations reveal an upward trend in cumulative and annualized returns as the allocation to Bitcoin increases, as presented in Figure 1. While the BlackRock Strategy delivers a cumulative return of 62.16% and an annualized return of 5.72%, Scenario 3 (20% Bitcoin) achieves a significant jump, with a cumulative return of 145.98% and an annualized return of 10.91%.

However, higher allocations entail larger volatility and drawdowns. The annualized volatility increases from 10.74% for the BlackRock Strategy to 15.08% in Scenario 3, and the maximum drawdown deepens from -29.44% to -42.63%. Yet, the Sharpe ratio continues to improve with higher Bitcoin allocations, peaking at 0.557 in Scenario 3. This indicates that the increased returns justify the additional risk within the tested range.

How Does Bitcoin’s Risk Contribution Change Across Allocations?

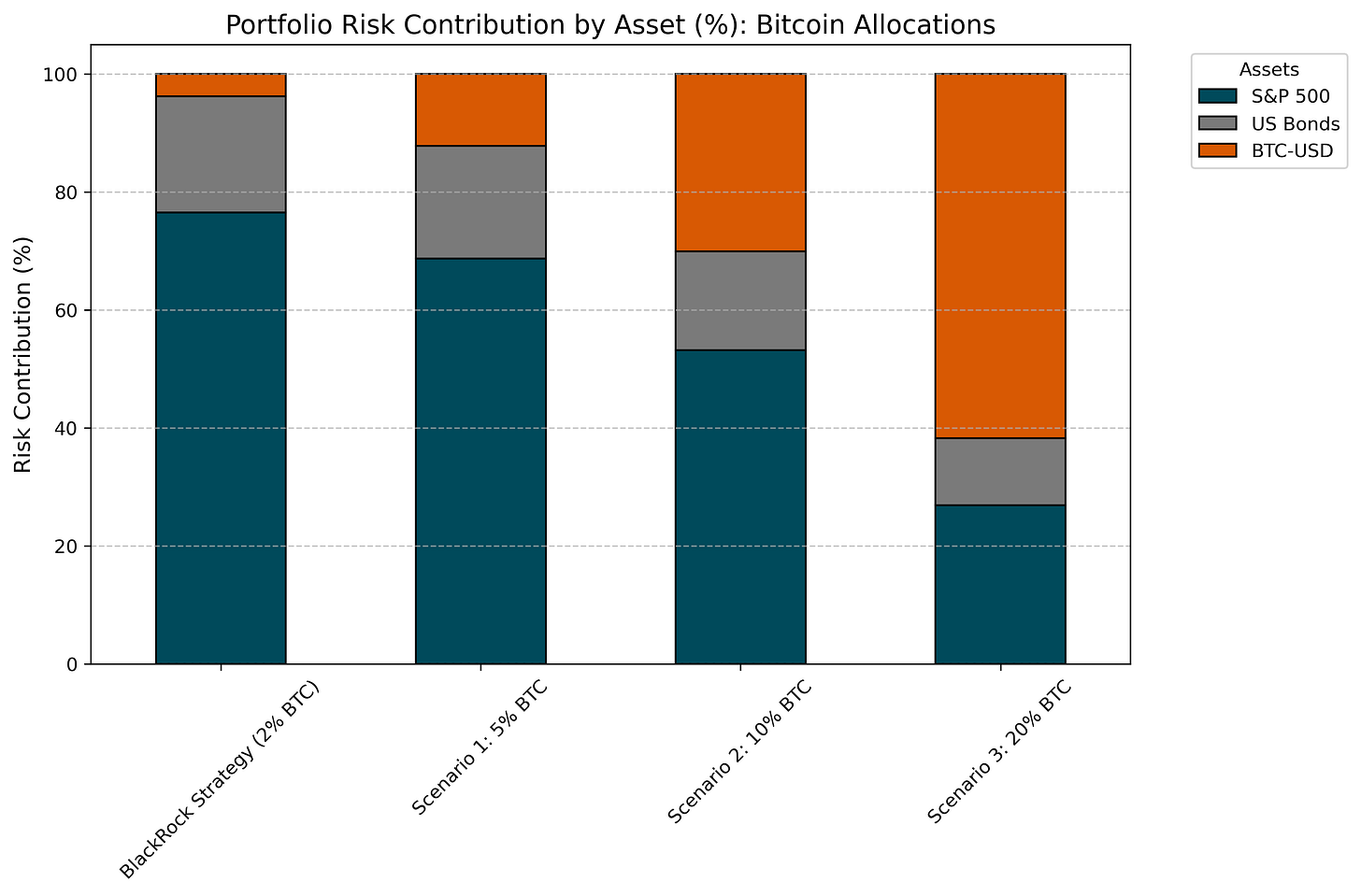

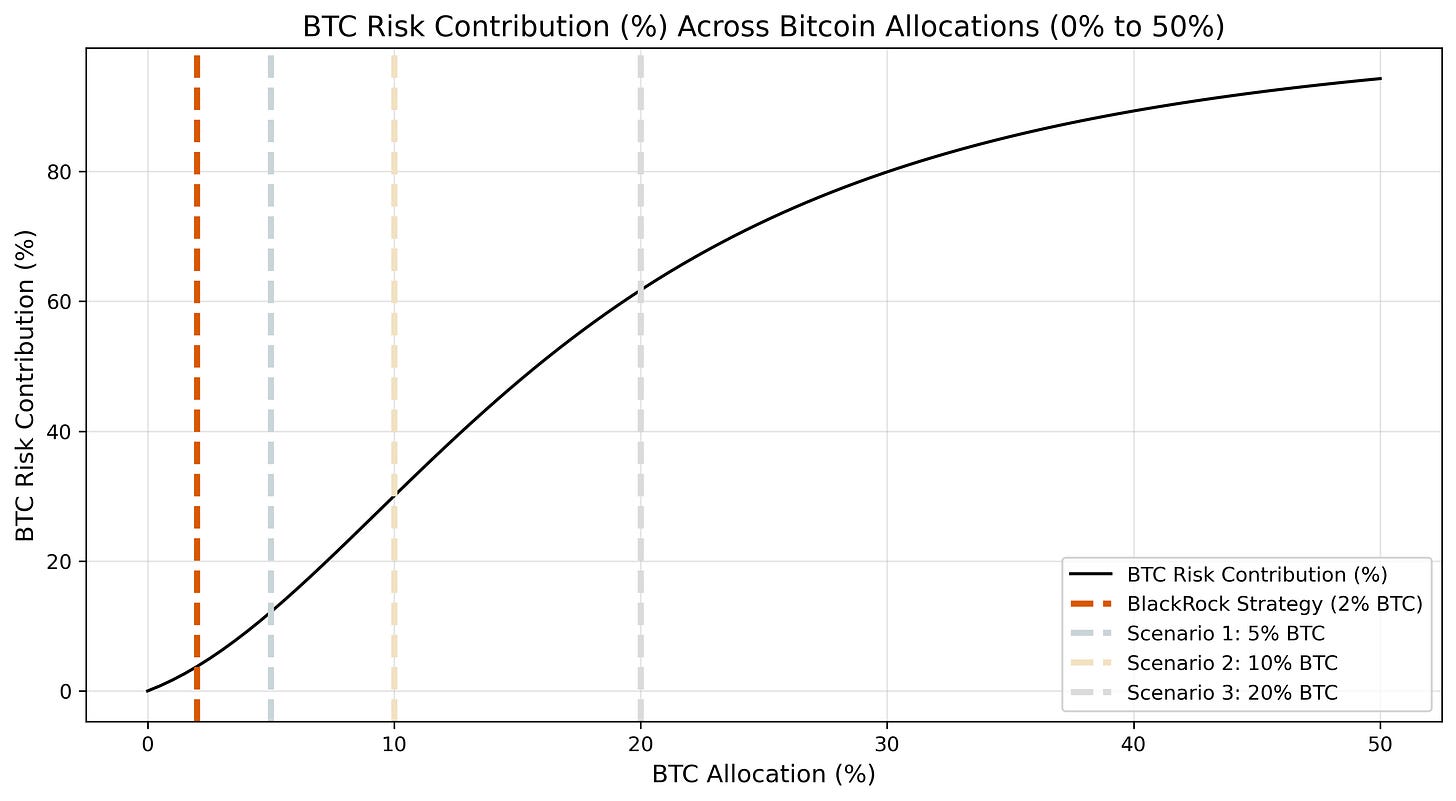

Bitcoin’s contribution to portfolio risk increases exponentially as allocations rise (Figures 2 and 3). At a 2% allocation, Bitcoin accounts for just 3.75% of total portfolio risk. However, in Scenario 2, with a 10% Bitcoin allocation, it represents nearly one-third of the portfolio’s risk (30.03%). This effect becomes even more pronounced with a 20% Bitcoin allocation, where Bitcoin contributes almost two-thirds of the portfolio’s risk (61.73%), while equities drop to 26.92% and bonds to 11.34%.

The continuous allocation chart (0–50%) of Bitcoin’s risk contribution in Figure 3 vividly illustrates this exponential growth. At a hypothetically extreme allocation of 30%, Bitcoin’s risk contribution reaches approximately 80% of the total portfolio risk. This dynamic underscores the trade-off between diversification benefits and concentrated risk. While modest Bitcoin allocations maintain portfolio balance, higher allocations shift the portfolio into a Bitcoin-dominated structure, significantly altering its risk profile.

What Is the Optimal Bitcoin Allocation Based on Sharpe Ratio?

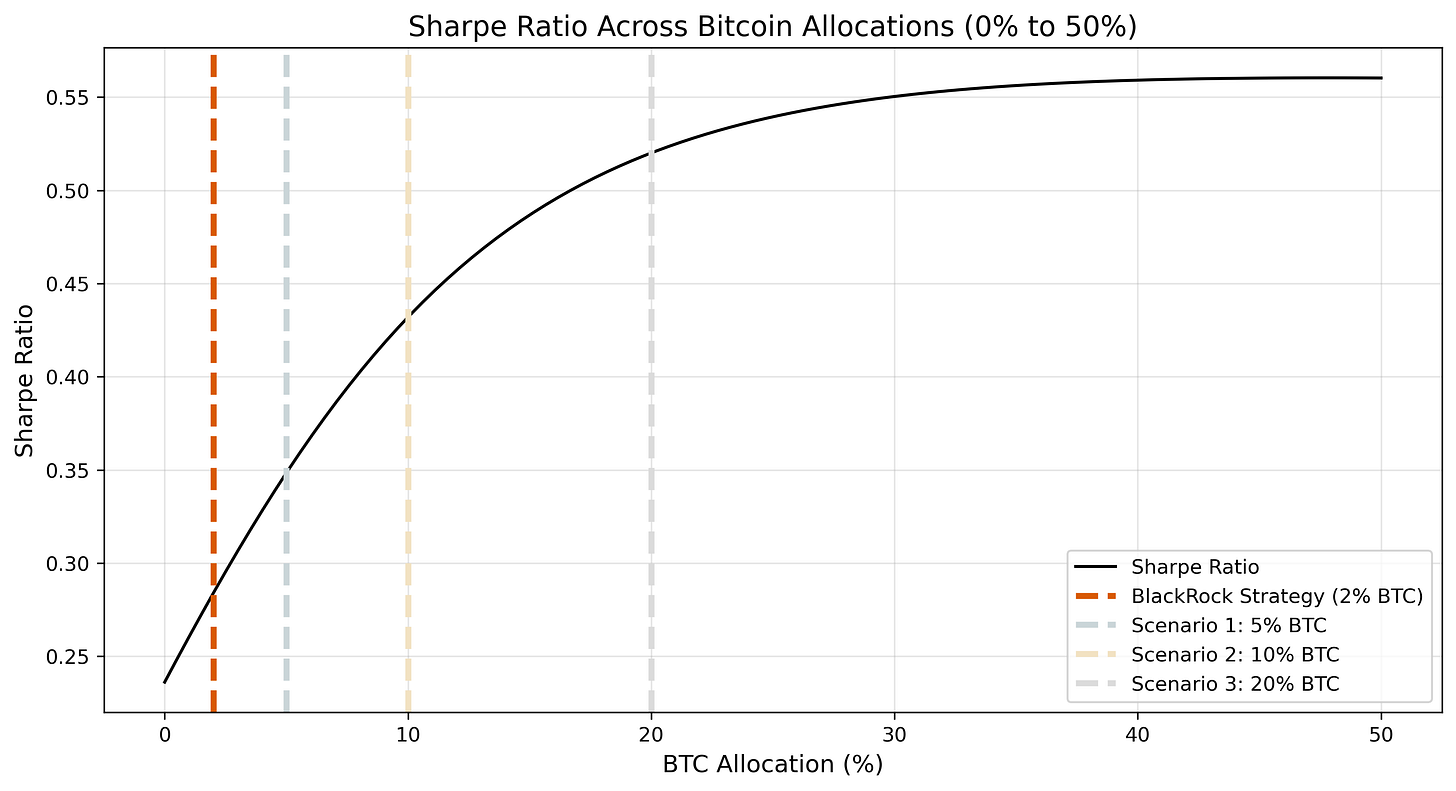

The continuous allocation chart (0–50%) for the risk-adjusted returns in Figure 4 offers visual insights into how the Sharpe ratio evolves with increasing Bitcoin exposure. The Sharpe ratio improves consistently, peaking near 20% allocation, where the incremental risk introduced by Bitcoin begins to outweigh its return enhancement. The data suggests that a Bitcoin allocation between 10% and 20% could theoretically provide an attractive balance of risk and return.

Overall, higher Bitcoin allocations enhance portfolio returns:

The 20% allocation (Scenario 3) delivers the highest Sharpe ratio.

However, this comes with increased volatility and risk concentration, as Bitcoin's contribution to portfolio risk surpasses 60% at higher weights.

Modest allocations maintain diversification, while larger allocations transform the portfolio into Bitcoin-dominated, emphasizing the trade-off between return potential and risk exposure.

Discussing BlackRock’s Investment Thesis

BlackRock argues that Bitcoin’s primary value lies in its potential for future adoption and its distinct characteristics as a decentralized, limited-supply asset. Our analysis corroborates this assertion, as Bitcoin’s performance as a portfolio enhancer appears to align with growing investor interest and demand.

While our analysis does not explicitly evaluate adoption trends, the cumulative and annualized returns for portfolios with Bitcoin allocations validate the asset’s outsized return potential, particularly in upward-trending markets.

Their recommendation of a 1–2% Bitcoin allocation reflects a balance between the asset's potential return and its inherent risks. Below, we synthesize our findings in light of BlackRock’s claims:

Implications for Portfolio Diversification

BlackRock’s Claim #1:

“Bitcoin offers a more diversified source of return with low intrinsic correlation to major risk assets over the long term.”

The correlation analysis supports this claim but adds important nuances. Over the 2019–2024 period, Bitcoin exhibited low and context-dependent correlations with traditional assets like bonds and gold, while correlations with equities were moderate and dynamic.

This observation suggests that Bitcoin’s diversification benefits depend significantly on market conditions:

Prolonged Downturns: During the 2022 Bear Market, Bitcoin’s correlation with equities strengthened, reflecting its partial risk-on nature.

Short-Term Shocks: During the COVID-19 crash, Bitcoin decoupled from bonds and showed low correlations with equities, demonstrating diversification benefits during specific stress periods.

These findings align with BlackRock’s assertion that Bitcoin’s value drivers are distinct from traditional assets, but they also highlight Bitcoin's situational alignment with risk assets during prolonged crises.

Bitcoin’s Behavior in Stress Periods

BlackRock’s Claim #2:

“Bitcoin may behave like a concentrated, high-risk asset similar to mega-cap tech stocks, such as Apple or Microsoft.”

The stress tests validate Bitcoin’s high-risk profile but also reveal its dynamic behavior:

During severe downturns like the COVID-19 crash, Bitcoin mirrored stocks, with significant drawdowns (-19.4% in BlackRock Strategy).

In the 2023 downturn, Bitcoin demonstrated reduced correlation with equities compared to earlier crises, suggesting evolving market behavior.

These insights align with BlackRock’s comparison to (tech) stocks while adding depth to its diversification narrative.

Sizing Allocations and Managing Risk

BlackRock’s Claim #3:

“A 1–2% allocation to Bitcoin balances its return potential with its overall contribution to portfolio risk. Beyond this range, Bitcoin sharply increases portfolio risk, undermining diversification benefits.”

The risk contribution analysis substantiates BlackRock’s position:

At 2% allocation, Bitcoin contributed only 3.75% to total portfolio risk.

However, higher allocations amplified risk exponentially, with a 20% allocation shifting Bitcoin’s risk contribution to over 61% of the total portfolio.

These findings reinforce BlackRock’s argument that higher allocations result in disproportionate risk concentration. But our analysis goes beyond BlackRock’s initial thesis by identifying allocation ranges for optimizing Sharpe ratios.

We find that allocations between 10% and 20% provide the best risk-adjusted returns, peaking at 0.557 in our scenarios.

The allocation scenarios offer a broader perspective on Bitcoin’s potential role in more aggressive portfolio strategies while highlighting trade-offs for diversification.

Conclusion

BlackRock’s investment thesis is largely validated by our findings:

Bitcoin enhances portfolio returns and provides diversification benefits within a well-diversified portfolio.

However, our analysis reveals nuanced dynamics in Bitcoin’s correlations, stress-period behavior, and risk contributions that add depth to BlackRock’s claims.

While a 1–2% allocation balances risk and return effectively, our findings suggest that investors with higher risk tolerance may consider allocations up to 10–20% to optimize risk-adjusted returns.

However, such allocations warrant further in-depth analysis, including advanced risk modeling and scenario-based simulations.

Understanding potential non-linear risks and forecasting Bitcoin's behavior under diverse market conditions will be critical for making informed decisions.